New and seasoned investors alike are often understandably concerned about the risks associated with investing. When analyzing those risks, it’s easy to focus primarily on volatility: periods of short-term uncertainty in the markets like we saw after the dot-com bubble in 2000, the 2008-2009 global finacial crisis, and the arrival of COVID-19 in the United States.

But when put into context, volatility is only a small component of the total risk associated with an investment portfolio, with the largest risk being investor behavior. The good news? Unlike volatility, investor behavior is something that you can control.

In this document, we’ll look at three investor behaviors — spending, approach to investing, and asset allocation — and examine how they can affect your investment portfolio.

We’ll also discuss volatility risk management, including a look at how asset-liability matching can help stabilize your portfolio. Finally, we’ll review the important role your Investment Policy Statement (IPS) can play in removing the emotion from investing.

One final note before we begin: We recognize that there are countless types of risks to your investment portfolio, including liquidity risk, concentration risk, interest rate risk, reinvestment risk, geopolitical risk, and more. This document presumes that your portfolio is already prudently diversified to manage and balance those types of risks.

The spending rate from a portfolio has a greater impact on the portfolio over time than any other factor, including short-term market changes, asset allocation, investment selection, and market timing. While investors have little to no control over the markets, they do have control over how much they spend from a portfolio.

Let’s take a look at how reducing one’s spending rate can have a compounded impact on portfolio durability. Consider an investor with a remaining life expectancy of 25 years who has a $1 million portfolio (75% equities/25% bonds) at retirement. If they spend 6% ($60,000) of that portfolio each year, the income earned from dividends and interest on the investments will not be enough to offset the stress on principal; and the likelihood of that portfolio surviving the entire 25-year period is less than 50%. In this scenario, the investor’s only hope is that the stock market achieves an above-average return over the entire 25-year timeframe — never a prudent strategy, and especially not in retirement.

But what if that same investor spends only 4% ($40,000) each year? At that rate, the likelihood that their portfolio will be depleted within 25 years declines to around 5%. In addition, there is a 50% probability that the portfolio will retain its original purchasing power.

The moral of the story? By setting a sustainable spending rate, you can directly enhance and control your portfolio’s long-term viability.

The second-biggest risk to your portfolio comes from how you approach investing.

Most people are familiar with the advice to “buy low and sell high”; but how many of them actually follow it? It’s much easier said than done. In fact, countless studies prove the same point: stocks are the one thing that many people won’t buy on sale. This behavior is understandable: when a portfolio’s value rapidly declines, the natural reaction is to get scared about losing everything and to flee from the portfolio (i.e., sell shares).

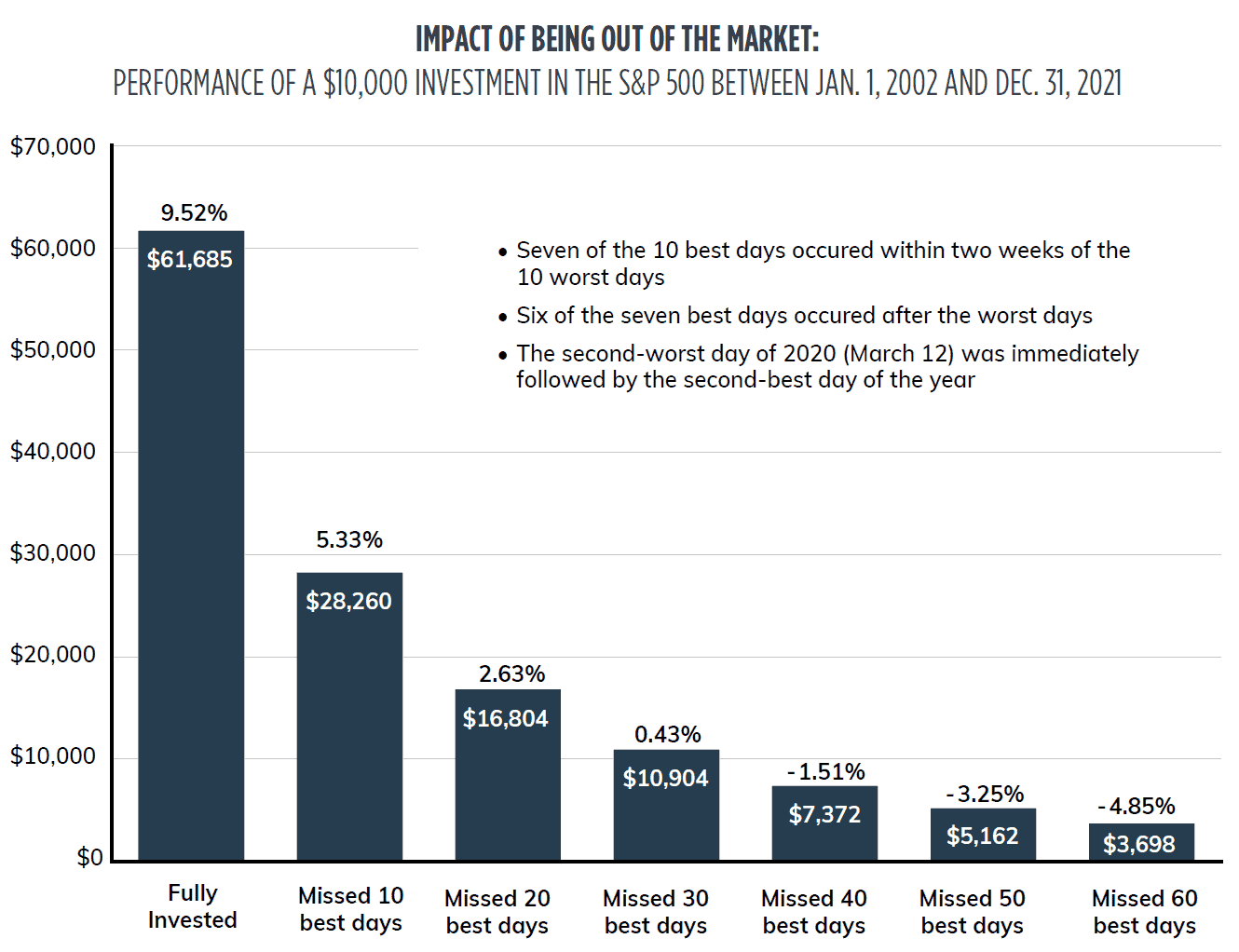

However, when investors develop the discipline to ignore the fear, keep an eye on the long-term horizon, and stay invested in chaotic markets — as unnatural as it may feel — they benefit greatly. Time and time again, history has shown that even missing just a few good days can dramatically undermine portfolio returns.

In the 20-year period from January 2002 to December 2021, for example, seven of the 10 best days in the market occurred within two weeks of the 10 worst days in the market. When fear during volatile periods pushes investors out of the market, they end up missing the rebound on the other side.

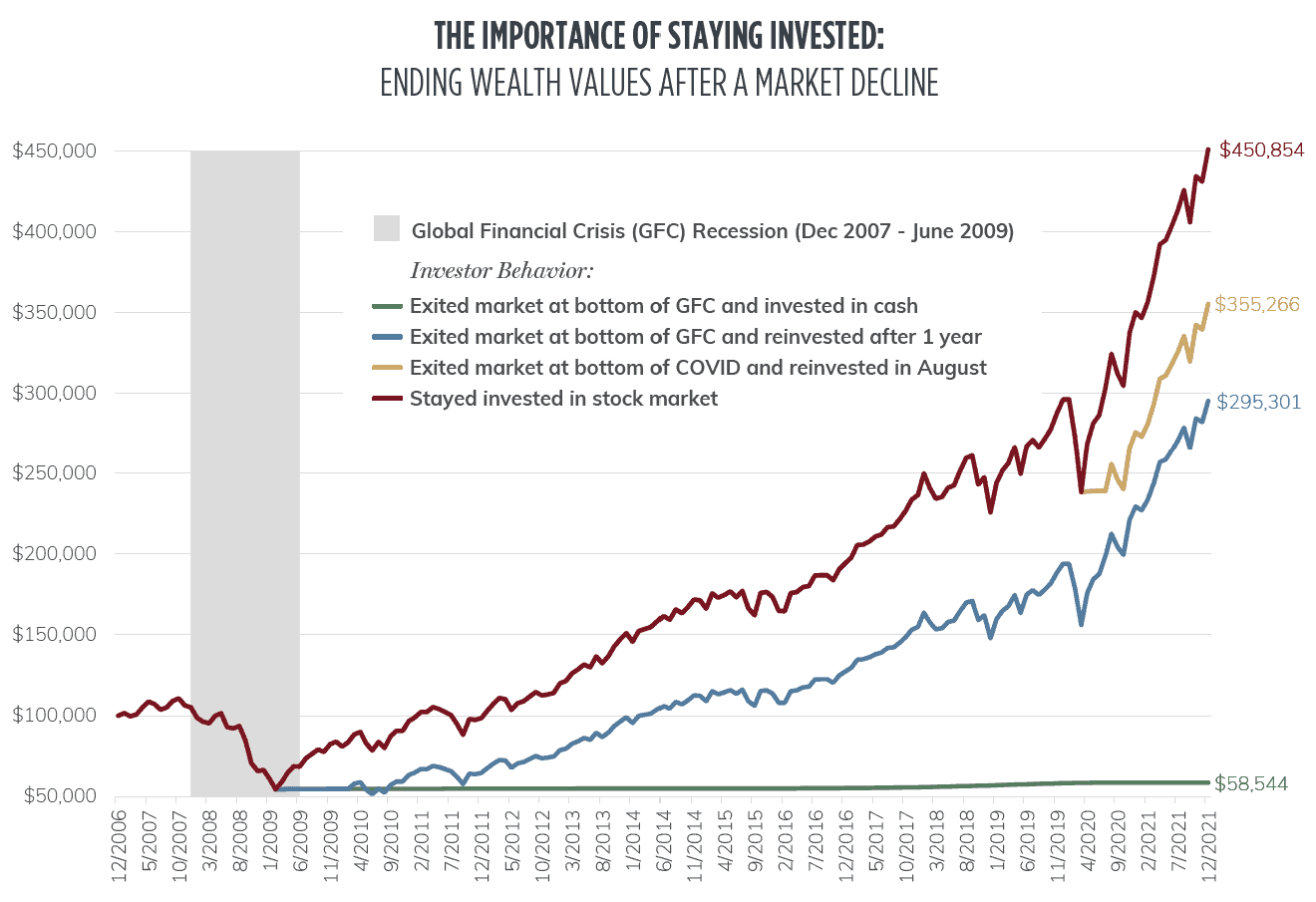

What does this mean numerically? The graph below looks at the performance of a $100,000 investment in the S&P 500 Index on December 2006 based on whether the investor stayed invested in the market through December 2021 or exited the market during a crisis and did not reinvest until later (if at all). The differences are dramatic: someone who remained fully invested throughout that entire period ended up with $450,854, while someone who exited the market at the bottom of COVID and did not reinvest until August 2020 ended up with $355,266. Someone who exited the market at the bottom of the global financial crisis and did not reinvest until a year later ended up with $295,301. And someone who exited the market at the bottom of the global financial crisis and invested solely in cash ended up with $58,544 — a far cry from the $450,854 they would have ended up with had they remained patient and stayed in the market the entire time.

The moral of the story? In periods of volatility, close your eyes, take a deep breath, consult with your trusted financial advisor, and review the plan you already have in place thanks to your Investment Policy Statement (IPS), which we will go into more detail about in the final section of this document.

If nothing significant in your life has changed, don’t change your IPS. Stay the course and let your long-term goals, not fear and other emotions, guide your investment strategy.

Many investors have a distorted view of the risks associated with each asset class. The risks associated with stocks are in our face every day, while the risks associated with long-dated bonds occur over time, so we don’t often hear about them in the news. As a result, many investors view stocks as risky and fixed-income instruments as safe.

The relative safety of bonds, however, depends entirely on the interest rate environment. Over time, inflation erodes the purchasing power of a bond’s principal and fixed interest payments.

In the 1980s, bonds were safe investments because interest rates were high enough to compensate investors for declining rates of inflation.

Times have since changed. Current interest rates are oof the post-pandemic lows, but still below their long-term average. As a result, bonds are no longer the automatic safer option.

As an example, assuming a 3% inflation rate, the purchasing power of a 10-year bond with a 2.5% yield will drop 26% by the end of 10 years, while the purchasing power of a stock with a 2.5% yield (and which increases its dividend by 8% annually) will increase by 61%.

The moral of the story? How you choose to divide your portfolio between stocks and bonds can have a significant impact. Work closely with your financial advisor to ensure that you’re choosing the best allocation for your current circumstances.

When advising clients on how best to structure and manage their portfolios, we talk in depth about their short-term and long-term needs and goals; and our advice to someone who plans to retire in three years would differ greatly from our advice to someone in their 30s.

This is where the strategy of asset-liability matching comes into play. It involves matching long-term liabilities with long-term assets and matching short-term liabilities with short-term assets.

Asset-liability matching follows a two-pronged strategy:

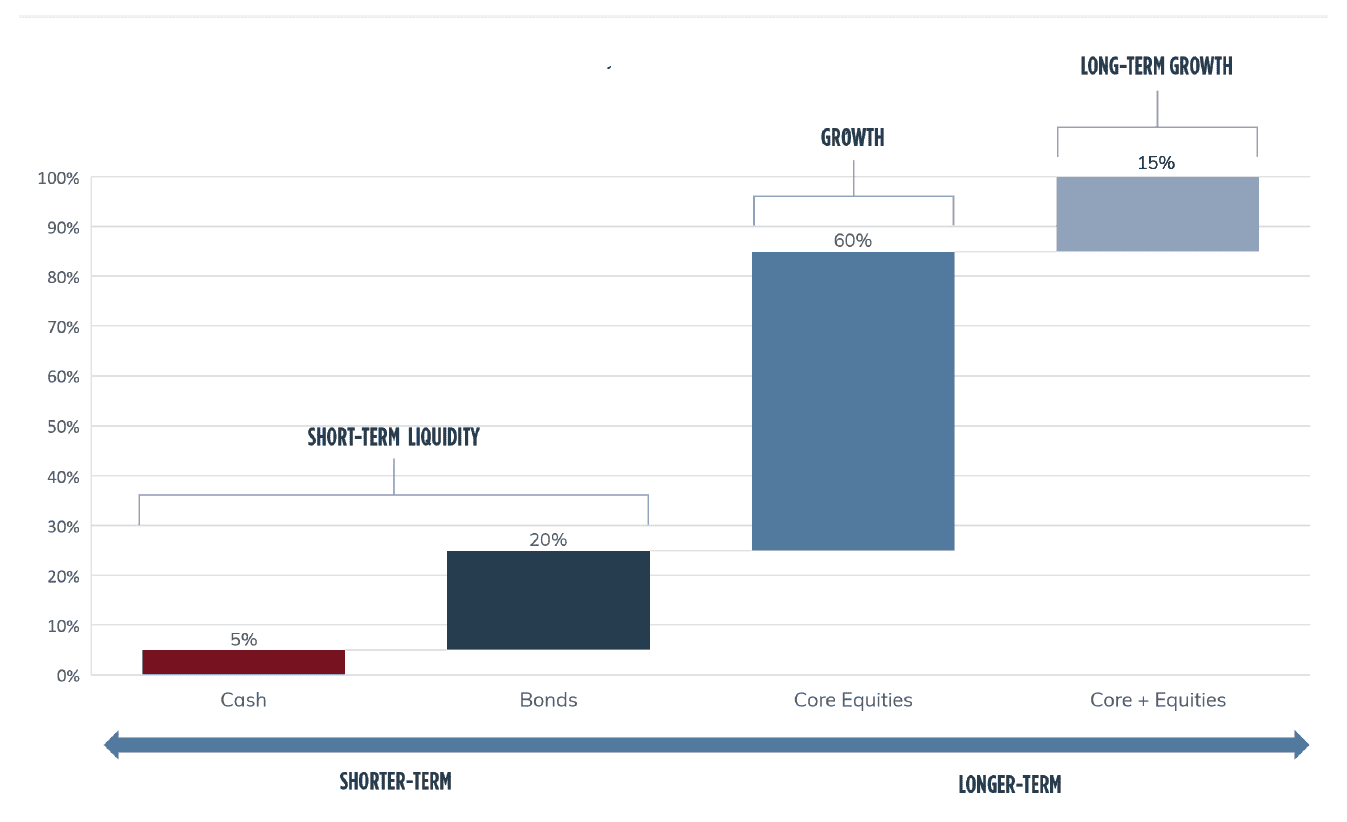

The graph below illustrates how this works. Ideally, a portfolio would allocate cash assets for immediate-term (1 to 2-year) needs such as current living expenses or purchasing a car. It would allocate bonds for short-term (3 to 5-year) needs such as future living expenses or saving for a house. Then it would allocate stocks for longer-term needs such as retirement.

We recommend allocating at least three to five years of known liquidity needs in cash and bonds. This allows investors to remain patient and think long-term during the inevitable turbulent periods the stock market will experience. The last thing you want to be forced to do is to sell high-quality stocks at depressed values just to support your current liquidity needs.

An asset-liability matching strategy is most successful when an investor maintains his or her spending rate at a sustainable level and stays invested without reacting emotionally during volatile markets (as outlined in the first two behaviors discussed above).

As we discussed in our note on Planning for the Unexpected, your IPS serves as your portfolio’s cornerstone document, one to which you should return whenever you’re in doubt about how to behave. It not only establishes clear investment goals and objectives, but also removes the emotion from financial planning. It looks at your time horizon and your personal risk tolerance to determine your appropriate asset allocation, and also lays out your spending and cash flow requirements.

An IPS should be reviewed every two years, but never changed in reaction to short-term market movements. You should only make changes if your personal or financial circumstances change significantly (for example, if you were single when you developed your IPS but now have a family, chances are both your goals and your cash flow are quite different).

If you do not already have an IPS, we can work with you to create one. It will help create peace of mind and a clear path to your financial future.

As we hope this document has demonstrated, with some thoughtful planning and professional guidance you can have a lot more control over your financial future than the newspaper headlines would have you believe.

This newsletter is intended for educational purposes only. For financial planning advice specific to your needs or for further information, please consult your portfolio manager.

An update on the second round of sweeping legislative reforms