The year 2020 demonstrated that life, like the capital markets, is unpredictable.

To help minimize the disruption uncertain times like these can bring to our clients’ financial lives, we work closely with clients to prepare detailed financial plans specific to their circumstances.

A comprehensive financial plan, prepared by a CERTIFIED FINANCIAL PLANNER™, involves more than just running projections to determine how much you need to save to retire at age 65. The true value of a well-crafted financial plan is that it serves as a guide when things don’t go the way you might have predicted.

The events for which we can help you prepare fall into four broad categories. The more prepared you are in each category, the more likely you are to weather the inevitable next storm with less damage and — equally important — less stress.

The first category is market volatility. While it is not possible to time the market, we can help you take specific steps to protect yourself.

The second category is a loss or reduction in your income. To minimize the impact of this event, we can help you take an inventory of your cash flow, create a balance sheet, and establish an emergency fund.

The third category is unforeseen events such as health-related issues and natural disasters. A full insurance review, with close attention to several key factors, can help ensure you’re adequately covered for these events.

The fourth and final category is the one that people have the hardest time planning for – death. Estate planning is one of our key areas of focus and expertise. Keep reading to hear our thoughts on why it matters so much.

Market volatility, or large swings in the market over short periods of time, can be upsetting to investors, triggering an understandable fear of loss. Very often, this short-term emotional instinct works against investors, distracting them from their long-term goals and leading them to sell their stocks at depressed values.

The following are several steps we can help you take to prepare for, and safeguard against, inevitable future periods of market volatility:

1- Develop an Investment Policy Statement

(IPS). An IPS helps us determine the best asset allocation for you by establishing clear investment goals and objectives around things like:

2- Review your IPS every two years. An IPS is not designed for you to change it in reaction to external factors like short-term market movements; we only recommend adjusting it if your personal circumstances change significantly (for example, if you were single when you developed your IPS but now have a family, chances are both your goals and your cash flow have changed).

3- Diversify your portfolio across appropriate asset classes and sectors.

The three main asset classes are cash, bonds, and stocks. Stocks can then be divided into large-cap US (shares of U.S. companies with market capitalizations of $10 billion or more), mid-cap US ($2 billion to $10 billion), smallcap US ($300 million to $2 billion), and international developed and emerging markets. Diversifying your assets can create a balance between risk and return. For some investors, depending on their net worth and overall objectives, it might make sense to add alternative investments such as Private Equity to their allocation.

Diversification across sectors means allocating your investments across various industries such as health care, financials, and technology. This is the financial equivalent of not putting all your eggs in one basket. The IPS may at times detail specific industries or sectors in which you do NOT want to invest for personal reasons. An example of this would be electing

to follow an environmental, social and governance (ESG) or Sustainable Investing mandate that only invests in companies that pass a screening process for these attributes.

4- Rebalance your portfolio periodically. Once you have determined in your IPS what your asset allocation should be, it is prudent to rebalance occasionally to bring your percentages back in line with your target allocation. For example, perhaps your IPS reflects a strategic asset allocation for your current situation of 80% stocks and 20% bonds and cash. Over time, due to varying growth rates of your individual investments, your actual allocation may become 90% stocks and 10% bonds and cash. When this happens, it makes sense to restore the allocation back to the original target. Part of this exercise also involves restoring your predetermined number of years of liquidity needs to the target level.

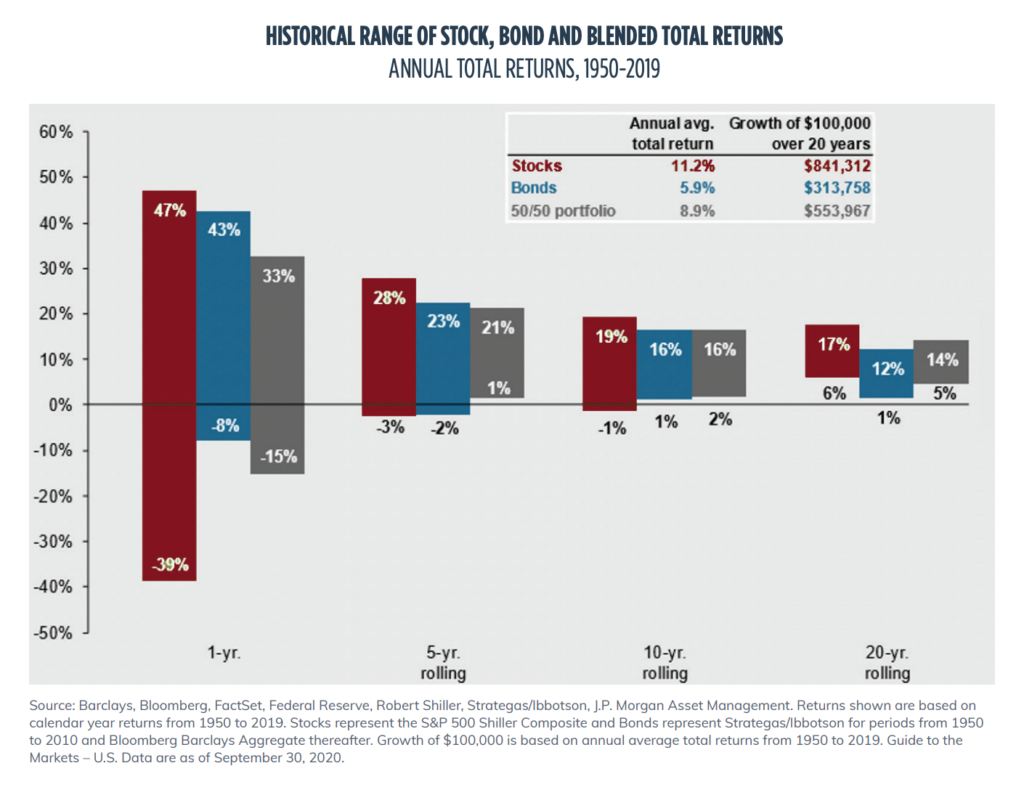

5- Be patient. Patience is one of the most important tools you can utilize while building and developing your investment portfolio. Periods of low or negative market returns as well as periods of volatility are inevitable. Major market disruptions such as the dotcom bubble of 2000, the financial crisis of 2008-2009, or the current global pandemic are unpredictable and cause dramatic disruptions to the stock market. These periods cause a lot of anxiety for investors but, as we’ve seen, those who remain calm and stick to their plan have the most success over time. As the chart on the opposite page details, stock market returns in the short term are very hard to predict. That said, the longer your time horizon is for investing, the more predictable the outcome or average rate of return is likely to be.

Another event for which we can help you prepare is the economic uncertainty caused when you experience a loss or reduction in your income. To safeguard against this type of upheaval, we recommend three steps:

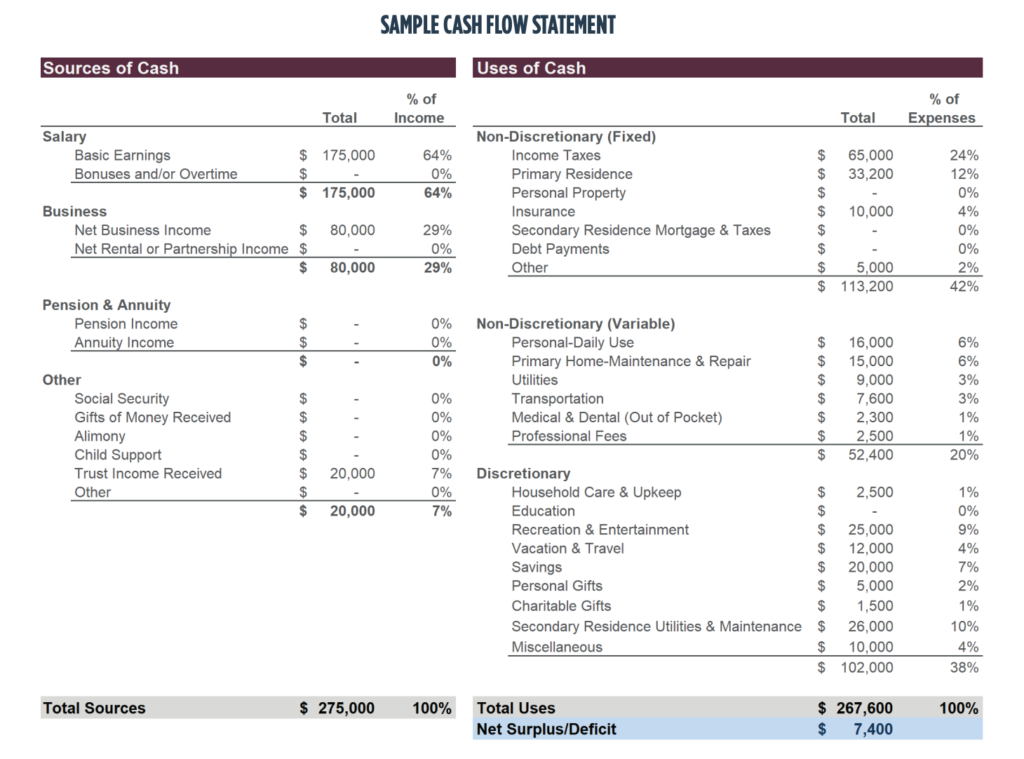

1- Conduct an inventory of your cash flow. A cash flow statement gives you a clear picture of your income (salary, rental properties, etc.) and your expenses. That clear picture allows you to see which expenses you could quickly reduce in an emergency. A cash flow statement covers three expense categories:

Once you have filled in the blanks, you can use the results to analyze what, if any, adjustments you need to make.

Next, establish two different budgets. One is your normal budget, including savings. The other is a backup budget to be implemented quickly in case of emergency. Perhaps your normal grocery budget is $600/month, but you know you could make do with $400/month if you had to; or maybe it is something bigger, like postponing a vacation for which you’ve been saving.

Identifying in advance which expenses you could cut, and by how much, can eliminate an extra source of stress should something unexpected happen.

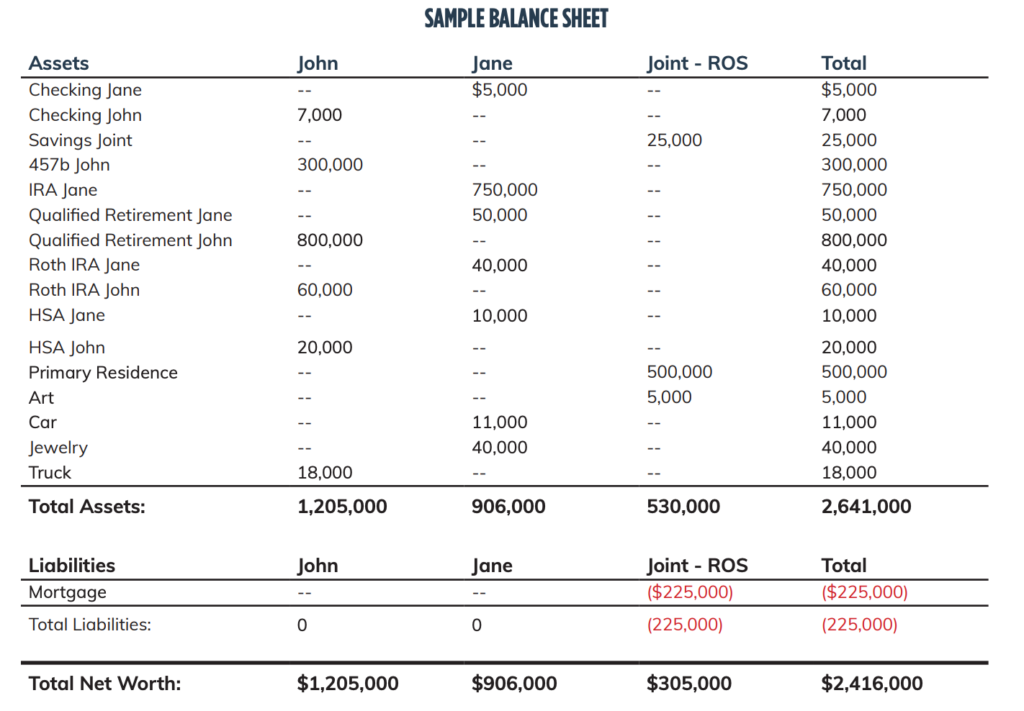

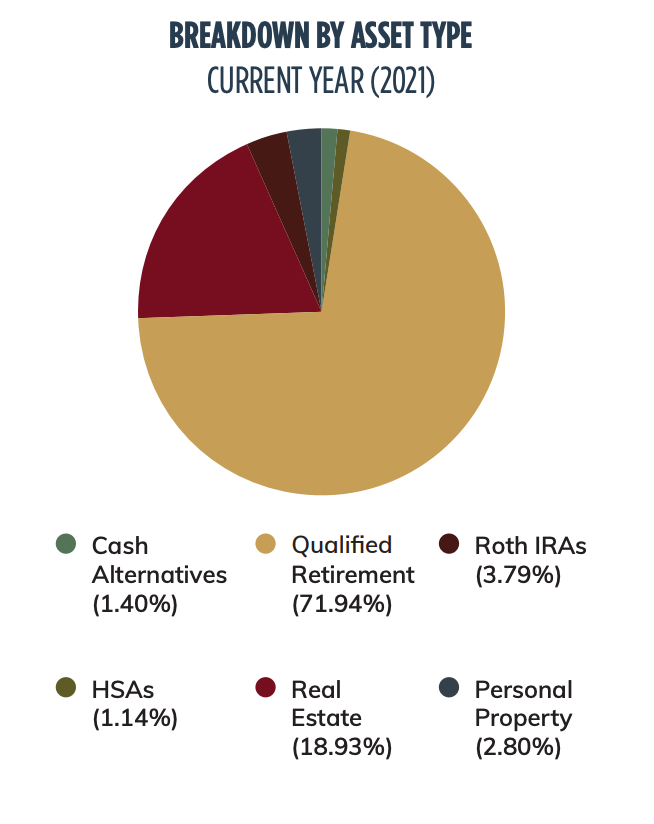

2- Create a balance sheet. A balance sheet is another useful tool in preparing for the unexpected. It lists your assets (what you own) an your liabilities (what you owe), which in turn allows you to calculate your net worth (assets minus liabilities).

Assets include things like cash, investment portfolios, and real estate. Balance sheets list them from most liquid (easiest to convert to cash) at the top to least liquid at the bottom.

Liabilities include things like credit card debt, mortgages, and loans. Liabilities can be a source of stress and inflexibility, so one of your primary financial goals should be to minimize them.

3- Establish an emergency fund. Once you have conducted your cash flow analysis, you will have a clear idea of your regular expenses. The goal with an emergency fund is to set aside enough money to cover at least three to six months’ worth of those expenses. This grants you breathing room if you find yourself out of work or facing significant unexpected expenses such as medical bills, house repairs, or the need to replace a major purchase such as a car or a computer. It buys you some time to find a solution without having to go into debt or sell high quality stocks and generate capital gains.

One of the best ways to grow your emergency fund is to set up a separate savings account for it. This provides you with the satisfaction of watching your emergency fund grow each month, and the compartmentalization makes it less tempting for you to draw from the fund for non-emergency purposes. When you try to establish an emergency fund simply by trying to build up three to six months’ worth of expenses in your regular checking account, it’s far too easy to dip into that excess for other purchases.

Risks to your financial situation extend far beyond market volatility and reduction or loss of income. Health issues, natural disasters, accidents, and crimes can also have significant effects.

Depending on your age, family situation, health, and assets, different types of insurance policies can help safeguard against, or at least offset, many of these risks. We recommend conducting a full insurance review with a CERTIFIED FINANCIAL PLANNER™ to identify the greatest risks to you and which types of insurance policies would best counter them. Questions to consider include:

What kind of health insurance do you and your family members have?

Do you have a Health Savings Account (HSA)? HSAs can have significant tax benefits if you are on a high-deductible plan. Contributions are tax-deductible, any interest or growth (some HSAs allow you to invest the funds) is tax-free, and you can make tax-free withdrawals to cover qualified medical expenses. They can also be an excellent way to save money for medical expenses in retirement.

Do you have (or need) disability insurance? If so, does it cover cases in which you are no longer able to perform the same job that you currently perform?

Do you have (or need) long-term care (LTC) insurance? LTC helps preserve your assets from being depleted in the event you need long-term nursing care. Traditional LTC insurance policies can be expensive and difficult to qualify for, so it is important to determine the appropriate amount of coverage and the optimal age at which you should apply.

Is your property (home, auto, boat, etc.) adequately insured? Not just against flood, fire, and theft, but also in terms of liability? More often than not, an insurance review reveals an insufficient level of liability coverage. Liability insurance protects your assets by limiting the amount of out-of-pocket expenditures you would have to make in the event that you were found at fault for an accident, property damage, or personal injury of another individual while at your home, in your car, or on your boat. For many individuals, umbrella insurance covering the policyholder and other household members is an affordable way to cover claims in excess of regular policy coverage.

Does the primary income earner in your household have life insurance? How much income would need to be replaced if that individual died? It often makes sense to layer a series of term life policies to cover specific liabilities and expenses of limited duration, such as college tuition and mortgage payments.

Life insurance isn’t the only preparatory step you should take in advance of your demise. Very few people are comfortable discussing their own mortality, but it’s vital to get your affairs in order while you still can, even if you think you are in great health. Crimes happen, accidents happen, cancer happens, and pandemics happen. Taking the time to meet with an estate planning attorney to document your goals and wishes is the best gift you could leave your loved ones.

In addition to helping you draft a will, an estate planning attorney can help you complete healthcare directives which specify your wishes regarding difficult decisions. Outlining those wishes in a legal document can ensure they are respected and prevent family fights. An estate planner can also help you preserve your legacy for the next generation, walking you through the intricacies of estate taxes and philanthropic bequests.

Review your will every five years or as your personal and/or financial circumstances change. If you divorce and then remarry, you don’t want your estate going to your ex-spouse because you never updated your will.

All of this information can seem overwhelming, but a solid plan will prevent you from having to do the wrong thing at the wrong time, such as selling high quality stocks during market lows or taking on high-interest debt.

You are in a much better position to make sound decisions when you have the time and energy to evaluate your options. When you do so from a position of strength, involving your trusted financial, legal, tax, and insurance advisors, you will arrive at rational, rather than emotional, decisions.

Regardless of your current stage of life, we can help you prepare a solid framework to weather the unexpected. For more information about risk management strategies, budgeting, and other financial planning best practices please visit our Insights page or call us to speak with someone in our Financial Planning Group.

This newsletter is intended for educational purposes only. For financial planning advice specific to your needs or for further information, please consult your portfolio manager.

An update on the second round of sweeping legislative reforms