In recent months, more and more people have been discussing the benefits of converting Traditional IRAs to Roth IRAs. In this planning note, we will outline what to consider when thinking about whether a Roth conversion is right for you. Please note that the tax impacts of a conversion vary; so before taking any action, make sure to consult your tax advisors.

Both Traditional and Roth IRAs allow assets to grow tax-deferred; but they have some key differences.With a Traditional IRA, investors who are 1.) Under a certain income and 2.) Not covered by a retirement plan through work can make tax-deductible (pre-tax) contributions each year. When you make a withdrawal, the funds are taxed as ordinary income. Traditional IRAs require you to begin taking distributions by a certain age, which used to be 70½, but was changed by the SECURE Act to 72 for those who were not 70½ at the end of 2019. By contrast, a Roth IRA, created by Senator William Roth in 1997 as part of the Taxpayer Relief Act, allows investors to make annual contributions with after-tax dollars. The primary benefit and the reason Roth IRAs are so attractive is that distributions are tax-free and there are no required distributions at any age. So, if you do not need to access the money in retirement, you can continue to grow your Roth IRA unhampered by taxes or mandatory distributions. Both Traditional IRAs and Roth IRAs have rules around distributions prior to age 59½ that should be reviewed if funds will be needed prior to that age.

• Roth conversions can be powerful tools for legacy planning

• Conversions don’t need to be all or nothing; partial conversions might be the most efficient way to achieve your goals.

• Roth conversions do not make sense for everyone and should be evaluated carefully with your tax advisor.

A Roth conversion occurs when you take Traditional IRA assets (some or all) and transfer them into a Roth IRA. Since Traditional IRA distributions are taxable, you have to pay taxes on the money you transfer. The taxes owed can be significant depending on your tax bracket; but any future withdrawals from the Roth IRA (by you or your heirs) will be income tax-free.

Yes and no. To be eligible to make annual contributions to a Roth IRA there are income limits you can’t exceed. In 2021 the income limit for an individual to make a full contribution was $140,000 and joint income can’t exceed $208,000. That said, in 2010 the government began allowing Roth conversions; and a Roth IRA that is created through a Traditional IRA conversion is not subject to any income limits.

As with many financial planning considerations, it’s not that simple. To make the best decision for your situation, you need to understand the rules and potential consequences. For example:

• Assets converted from a Traditional IRA to a Roth IRA are taxed at your current tax rate. Often, this will result in a hefty tax bill, especially if you live in a high-tax state.

• Conversions increase your income in the current tax year, potentially affecting other retirement expenses. For example, your Medicare premiums (determined by your income two years prior) can increase if the conversion pushes you into a higher tax bracket.

Depending on how many of the following scenarios apply to you, you’ll get a clearer picture as to whether there are more pros or cons and whether a Roth IRA conversion makes sense for you at this point in your life.

• Your main goal is to transfer the money in your traditional IRA income tax-free to the next generation. Before the SECURE Act, this

was often accomplished with a stretch IRA. Specifically, a non-spouse beneficiary who inherited an IRA could stretch out distributions throughout their lifetime, allowing the IRA assets to keep growing without triggering a large tax bill for the beneficiary. Since the SECURE Act did away with stretch IRAs, non-spousal beneficiaries (and a few other excepted categories) must now withdraw all the assets in the IRA within ten years of the original holder’s death.

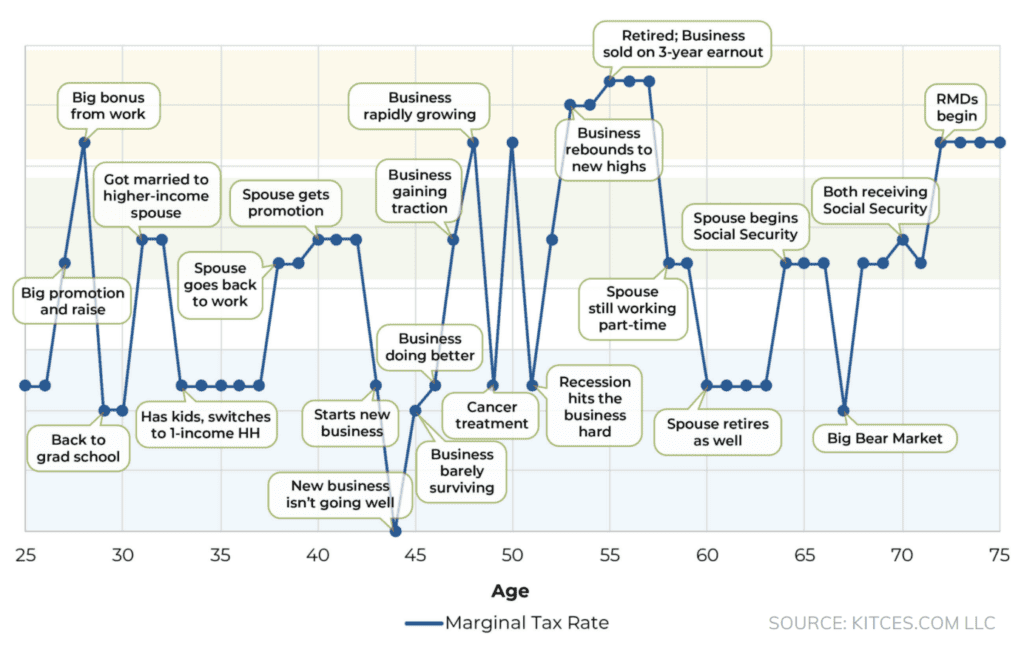

• You expect to move into a higher tax bracket and/or tax rates are expected to increase. The graph below demonstrates how various events throughout the course of your life can drive tax bracket changes.• You have the cash to pay the taxes outside of the IRA funds.

• There has been a sudden drop in the markets. If you’re converting a smaller amount of money, your resulting tax bill will be smaller and you are reinvesting the funds in the Roth IRA.

• You’re in a lower-income year.

• You have losses or deductions in the same tax year to offset the income increase caused by the conversion.

• You do not need the money anytime soon. The longer you wait to withdraw the money in your Roth IRA, the more time you’ll have to recoup your setback from the taxes paid for the conversion.

• You are moving to a state with higher state income taxes, in which case you might want to pay taxes on your conversion while still in the lower-tax state.

• A large portion of your Traditional IRA is from non-deductible contributions made over prior years (above a certain income level, you can no longer make tax-deductible contributions). For non-deductible contributions, only the earnings or appreciation would be included in the taxable component of the conversion. For example, if you made annual non-deductible contributions of $6,000 for ten years, totaling $60,000, and with market growth your IRA is now worth $100,000, you would not be taxed on the $60,000 (your basis), just the $40,000 of growth.

• You have retired but you’re not yet 72. For many people, this is the ideal time because they are in a lower income bracket but not yet required to take annual required minimum distributions (RMDs) from the Traditional IRA. RMDs are considered ordinary income and can increase your marginal tax rate.

• You do not have the money to pay the hefty tax bill associated with the conversion without dipping into your IRA funds. By using IRA funds, you would be paying taxes on taxes.

• It will bump you into a higher tax bracket.

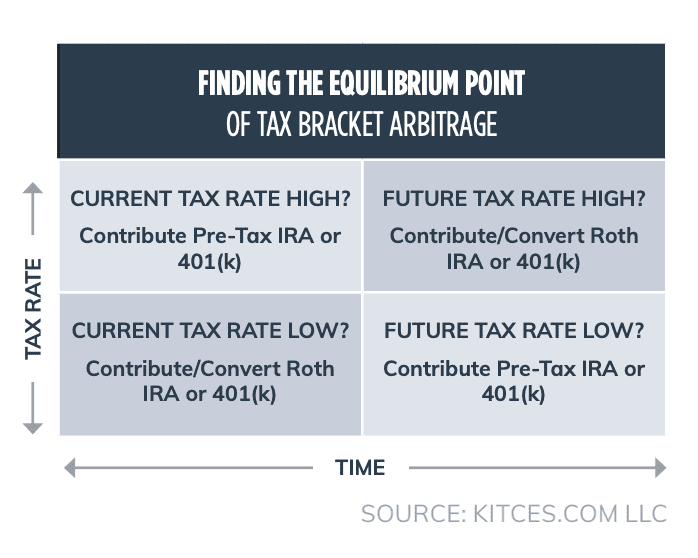

• You expect to be in a lower tax bracket later (such as in retirement). You always want to convert when you are in a lower tax bracket

• You plan to leave your IRA to a charity.

• You’re close to retirement and/or plan to live on the IRA RMD money in retirement.

Roth conversions don’t have to be all-or-nothing propositions. You can convert just a portion of your Traditional IRA, or you can spread the conversion out across several tax years. Often, people will convert as much as they can each year without moving into a higher tax bracket. Partial conversions can be excellent ways to diversify account types. Having both pre-tax and after-tax accounts allows you more flexibility to generate income for living expenses in retirement, and it can also mitigate the tax impacts of large RMDs. Depending on your income level in retirement, it might be more tax-efficient to realize long-term capital gains in taxable accounts than to take IRA distributions. For example, the long-term capital gains tax rate is 15% for most people. Let’s say you originally bought $50,000 of stock which is now worth $75,000. If you need $75,000 for annual living expenses and decide to sell all of that stock, you will have to pay 15% tax on the $25,000 of growth, so $3,750 in tax. If you instead decide to withdraw $75,000 from your Traditional IRA, the full $75,000 will be taxed according to your income tax rate. Depending on the year, that rate could be much higher than 15%. The most important takeaway here is that every situation is different, and whether or not to pursue a Roth conversion is not a black and white decision. As we have outlined, it depends not only on your short- and long-term goals, but also on the likelihood of certain situations and policies to unfold in the future. Of course, before you make this or any decision that has an impact on your tax situation, it is important to consult with your tax advisor. We are happy to work with them to run different scenarios and help you assess whether a Roth conversion is right for you.

This newsletter is intended for educational purposes only. For financial planning advice specific to your needs or for further information, please consult your portfolio manager.