As we approach the end of the year, most people have a lot on their plates. With that in mind, the following list outlines several financial tasks that you can start taking care of now for a less stressful month of December. Click here to download a printable version of this checklist.

Plan Out any Charitable Gifts

Since the Tax Cuts and Jobs Act increased the standard deduction, many taxpayers no longer benefit from itemizing deductions (including charitable contributions). In 2024, the standard deduction amount is $14,600 for single taxpayers and $29,200 for married couples filing jointly. That said, you can still support your favorite causes and organizations in tax-efficient ways. Depending on your charitable intent and your short- and longer-term goals, you may want to explore one of the following strategies:

- Give appreciated securities: If you do itemize deductions, this will allow you to avoid realizing capital gains and reduce your taxable income. Your deduction is limited to 30% of your adjusted gross income for the tax year. If you give more than the 30%, you are allowed to carry forward any unused deductions for up to five years.

- Bunch contributions to a donor-advised fund: You can maximize your itemized deductions in the current tax year by pre-funding future years of charitable giving. This strategy is beneficial if you are close to the standard deduction level or if you had an unusually large income year and want to offset some of the taxable portion.

- Give a Qualified Charitable Distribution (QCD) from your IRA: By giving some or all (up to $100k) of your Required Minimum Distribution (RMD) directly to qualified charities, you can fulfill your RMD obligation and the amount will be excluded from your taxable income. Reducing your income in this way may have additional benefits, like reducing your Medicare premiums in future years. This is a great way to use the standard deduction and still receive a tax benefit from your charitable gift.

Take your Required Minimum Distribution (RMD)

- Do Not Forget: there is a 50% penalty on the amount not taken out.

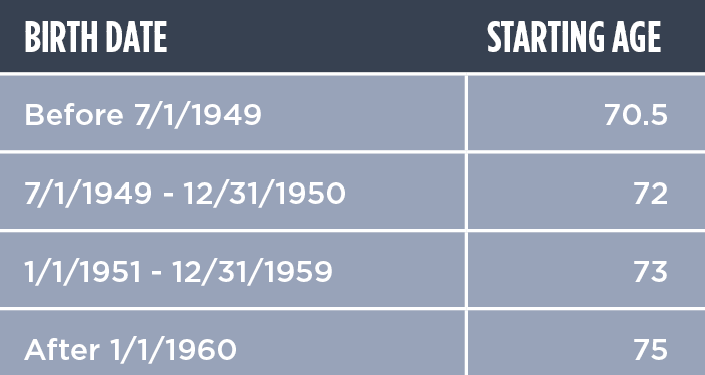

- The SECURE Act and Secure 2.0 may have increased your RMD starting age. Here is a quick breakdown:

- If you inherited an IRA from someone who died on or after January 1, 2020, you won’t be penalized for skipping your Required Minimum Distribution (RMD) this year. The IRS has waived penalties for missed RMDs from these inherited IRAs for 2024. However, taking a distribution might still be beneficial in your specific situation. Due to the complexity of inherited IRA rules, it’s advisable to consult with your financial advisor or tax professional for personalized guidance.

- Use these funds to help pay for living expenses, reinvest in a taxable investment account, or consider a QCD if you don’t need the funds.

Make Annual Gifts to Loved Ones:

A single person can give up to $18k to another individual each year, free of gift tax consequences. Married couples can each give $18k per year to an individual, for a total of $36k. These limits also apply to 529 college savings plan contributions. In addition, you can directly pay qualified education or medical expenses on behalf of loved ones without gift tax considerations.

Review Benefits of a Roth Conversion

- Evaluate converting all or some of your pre-tax Traditional IRA to an after-tax Roth IRA (read more in our note on this topic). You will have to pay taxes on the amount you convert, but some reasons it might make sense are:

- Income tax rates are likely going higher.

- You can pay taxes using cash outside of your Traditional IRA.

- Legacy planning; non-spouse beneficiaries now must withdraw the entire account balance within 10 years of inheriting it. They can withdraw Roth funds tax-free, but Traditional IRA withdrawals will be taxed as income.

Review Taxable Investment Accounts for Realized Gain/Loss Status

Evaluate the optimal timing of taking losses to offset gains. If tax rates are likely to go higher, it may make sense to wait; but if this is an above average income year, it may be more valuable to realize a loss now*.

(*As always, be sure to consult with your tax advisors before taking action.)

Review your 401(k) Allocation and Contribution Rates

People often ignore their employer retirement plans even though they can be one of your largest income sources in retirement.

Contribute to Your Health Savings Account (HSA)

If you are enrolled in a high-deductible plan, you are eligible to contribute to an HSA account. In 2024, the amounts are $4,150 for an individual, $8,300 for family coverage, and an extra $1,000 if over age 55. You technically have until April 15th of the following year to make the full contribution amount. Consider using a custodian that allows you to invest assets if you’ve accumulated a large balance. And if you have a Flexible Spending Account (FSA), make sure you use it all before year end or the balance will be forfeited.

Review Your Estate Documents:

You should do this every five years or whenever you have a change in your personal or financial circumstances.

Review Your Insurance Coverage:

Many homes have increased in value, or maybe you did a home improvement recently. Make sure your coverage limits are sufficient and that your umbrella coverage is enough to cover your investable asset levels.

This newsletter is intended for educational purposes only. For financial planning advice specific to your needs or for further information, please consult your portfolio manager.