Health care events can be unpredictable; and without insurance, they can be extremely expensive. And so, while premiums may be costly, health insurance is essential, as it mitigates the risk of taking on debt or dipping into emergency reserves, retirement savings, college savings, etc. to cover large medical bills. While people need health insurance at all stages of life, health care costs increase significantly with age, so it’s worth planning for them, particularly when approaching retirement.

How you obtain health insurance coverage depends on factors like your employment status, personal situation, and age. This note outlines the various ways of doing so, with an emphasis on planning for its costs in retirement.

When choosing a health care plan, you’ll want to consider each of the four following financial components:

Group health insurance policies are provided by employers to employees; and in general, they tend to be less expensive than individual plans.

If you are self-employed, or if you have left the workforce but are not yet eligible for Medicare, you might be able to find a good, affordable plan on the Health Insurance Marketplace (also known as the “Marketplace” or “Exchange”). The Marketplace was created under the Affordable Care Act and is operated by the federal government. To be eligible, you must be a US citizen or nationalcurrently living in the US. Incarcerated individuals and those who already have Medicare coverage are not eligible to use the Marketplace.

With a few exceptions, you must obtain coverage during the six-week open enrollment period, which is November 1st to December 15th of each year for coverage beginning on January 1st. That said, you may qualify for a special 60-day enrollment period directly following certain life events, which include getting married, having a baby, loss of job-related coverage, or loss coverage due to divorce or legal separation.

In the Marketplace, the cost of your insurance varies based on your total household income. In your application, you must include an estimate of your income for the year and that of all members of your household (including your spouse and anyone you plan to claim as a tax dependent on your federal income tax return), even if some members do not need health insurance coverage.

COBRA (“Consolidated Omnibus Budget Reconciliation Act of 1985”) policies provide continued health insurance coverage to individuals and dependents who have lost their group insurance because of a qualifying event such as job loss (including retiring), reduction in hours, or divorce from the eligible employee. With COBRA, the individuals can continue their health insurance coverage at group rates, as long as they pay for the coverage.

To be eligible, the employee and any applicable dependents must be enrolled in an employer-sponsored group health insurance plan on the day before the qualifying event occurs, after which they have 60 days to decide if they want to continue the health insurance coverage. If so, COBRA coverage begins after the employer coverage ends and can continue for 18 or 36 months, depending on the nature of the qualifying event.

COBRA is typically less expensive than an individual health plan but more expensive than what people previously paid under a group plan, simply because the employer won’t be covering a portion of the premium.

Medicare is a federal health insurance program available to people 65 or older who have worked at least 10 years, during which they paid Medicare tax. Non-working spouses may also be eligible for Medicare at age 65, based on their spouse’s age and work record However, if the non-working spouse is older, they do not qualify for coverage until the younger spouse is at least 62.

Medicare has three distinct Parts: Part A provides hospital insurance; Part B provides for doctor visits or lab work; and Part D provides prescription drug coverage. Part C is a combination of all three, commonly referred to as Medicare Advantage.

Medicare Part A

At age 65, you receive Part A (hospital insurance) without having to pay a monthly premium, provided you have worked and paid at least 10 years of Medicare tax. If you do not qualify for premium-free Part A, then you can buy Part A; but if you do not purchase it when you are first eligible, you will have the added cost of a Part A late enrollment penalty — so do not delay in signing up.

Medicare Part B:

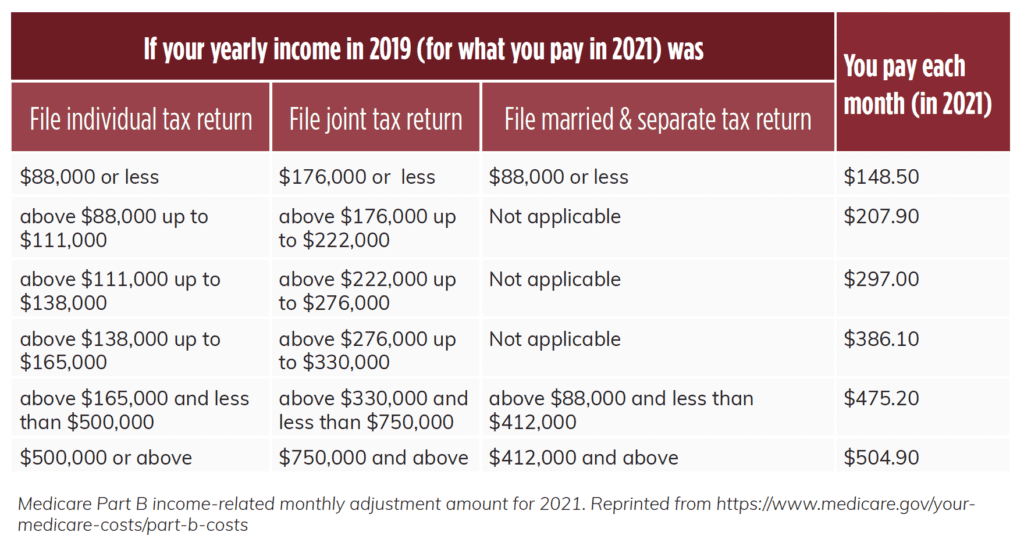

To receive Part B (doctor visits and lab work), you must pay a monthly premium. If you are currently receiving Social Security benefits, the monthly premium is deducted from your benefit amount. If not, Medicare bills you for your Part B premium every three months. The standard premium amount for Part B is $148.50 (for 2021), but it is income-based. If you have higher income as determined by your federal income tax return from 2 years ago, there will be an income-related monthly adjustment amount (IRMAA) included. For example, if a couple’s 2019 modified adjusted gross income was above $176,000 but less than $222,000, their monthly premium for 2021 would increase from $148.50 to $207.90 (see fig. 1). You can request that the Social Security Administration lower or eliminate your IRMAA if you experienced a life-changing event that caused an increase in income. Life-changing events include things such as the death of a spouse, divorce, or reduction in the number of hours worked.

In addition to the monthly premium, Part B also has an annual deductible ($203 for 2021). After meeting the deductible, you pay 20% of Medicare-approved cost for services.

Medicare Part D:

Medicare Part D is optional prescription drug coverage. The cost of Part D depends on the plan you select, and higher income individuals may pay more. If you do not obtain coverage when you are first eligible, a late enrollment penalty will apply, with a few limited exceptions. The penalty is calculated at 1% of the national base beneficiary premium ($33.06 in 2021) times the number of months you were not covered by Part D or other prescription insurance. This amount is then added to your monthly Part D premium and you must pay it for as long as you have the plan.

Medicare Advantage Plans (Medicare Part C):

You can combine Part A, Part B and Part D into a single Medicare Advantage Plan, which is often referred to as Medicare Part C. These plans are offered through private companies approved by Medicare.

Medigap Policies:

Medigap policies help pay for health care costs that Medicare Parts A and B do not cover, such as co-pays and co-insurance. To obtain a Medigap policy, you must first have Medicare Parts A and B; and if you have a Medicare Advantage Plan, you are not eligible for Medigap.

Medigap policies are sold by private companies at varying costs, so it is important to compare. There are up to 10 different Medigap policies to choose from, depending on where you live, each designated by a letter (A, B, C, D, F, G, K, L, M and N). Policies with the same letter offer the same set of standardized benefits, even though they are sold by different companies.

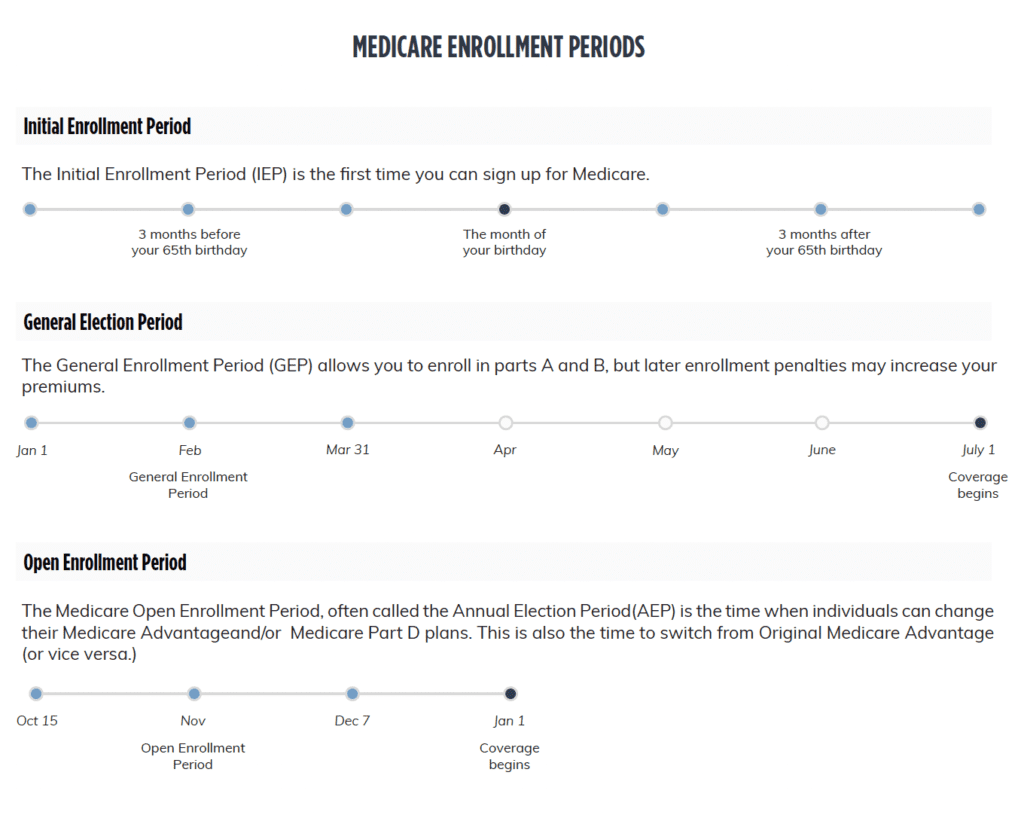

Initial Enrollment Period

Medicare Part A and Part B have a seven-month initial enrollment period. If you are eligible at age 65, then your seven-month enrollment period starts three months before the month you turn 65, includes your birthday month, and continues for the subsequent three months. If you do not sign up for Part A during that period, you can still sign up at any time, but your coverage date will not begin until after you have enrolled.

If you have to buy Part A coverage (meaning you are not otherwise qualified for Medicare), you may only sign up for Part A coverage during an enrollment period. The same is true for Part B. Also, if you do not sign up for Part A and Part B when you are first eligible to do so, you will have a penalty (but there is no Part A penalty if you qualify for premium-free Part A).

General Enrollment Period

In addition to your specific initial enrollment period, which is based on your 65th birthday month, there is always a general enrollment period for Part A and/or Part B each year. This period runs from January 1 to March 31. You can always sign up during this general enrollment period if you did not do so when you first became eligible or if you were not eligible for a special enrollment period (discussed below). If you sign up during this general enrollment period, your coverage will begin on July 1 and you will pay a higher premium due to your late enrollment.

Special Enrollment Period

If you and/or your spouse are currently working and are covered under a group health plan through your/your spouse’s current employer, you may qualify for a special Part A and/or Part B enrollment period. The special enrollment period extends for eight months, starting either the month after employment ends or the month after group coverage ends, whichever is earlier. If you sign up for Part A and/or Part B during this special enrollment period, you will usually avoid the late enrollment penalty. It is important to note that COBRA coverage is not considered group coverage for this purpose, and therefore you are not eligible for a special enrollment period after COBRA coverage ends.

Open Enrollment Period (aka Annual Election Period)

Once you are enrolled in Medicare, you do not need to re-enroll every subsequent year; but you can review and change your Medicare coverage during the open enrollment period, which runs from October 15 to December 7. If you are enrolled in a Medicare Advantage Plan, there is a corresponding Medicare Advantage open enrollment period from January 1 to March 31 during which you can make changes to your Medicare Advantage Plan or to switch back to original Medicare.

To help keep these enrollment periods straight, consult the Medicare Enrollment Periods chart below.

Figure 2. Chart of Medicare Enrollment Periods for 2020. Reprinted from https://www.healthmarkets.com/resources/medicare/when-is-the-medicare-part-d-open-enrollment/medicare-enrollment-periods/

Rising Health Care Costs

Historically, health care costs have increased faster than inflation. With medical advancements and new treatments, this faster-than-inflation pace is expected to continue.

As we age, health care costs increase, making up a larger percentage of overall expenses. Fortunately, reduced expenses in other areas such as travel and recreation help to counter rising health care costs.

What Rising Health Care Costs Mean for Retirees

If you retire before age 65, you must obtain private health insurance until you qualify for Medicare. To demonstrate how much private health insurance costs, we obtained an insurance quote through the Marketplace from Harvard Pilgrim for a 60-year-old. The cost for a gold-level policy includes a monthly premium of $1,010, a deductible of $1,200 and an out-of-pocket max of $5,800.

If you lost coverage under a group plan, another possibility might be COBRA. Coverage under COBRA will only continue for the prescribed time period (18 to 36 months depending on the qualifying event), so you’ll still need a backup plan if it expires before you are eligible for Medicare.

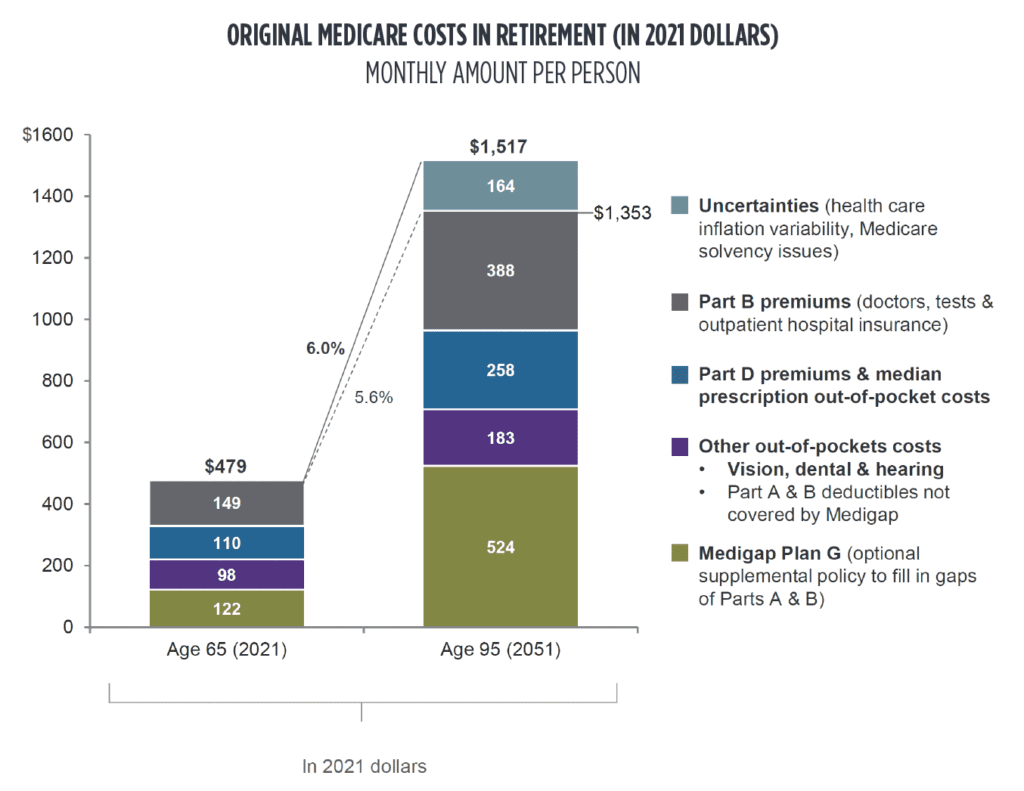

At age 65, your Medicare coverage will begin and your healthcare-related expenses will include your monthly premiums for Part B and Part D (plus Part A if you do not otherwise qualify for premium-free coverage), your co-pays, and your out-of-pocket expenses. These can add up to a significant amount each year. We estimate that an individual will pay $7,500/year for these expenses at retirement, with the expectation that the amount will grow each year. To demonstrate, the chart below compares the median Medicare health care costs of a 65-year-old with those of an 85-year-old.

Figure 3. Comparison of estimated median monthly Medicare health care costs of a 65-year-old with that of an 85-year-old. Adapted from ‘Guide to Retirement’ by JP Morgan, 2021 Edition.

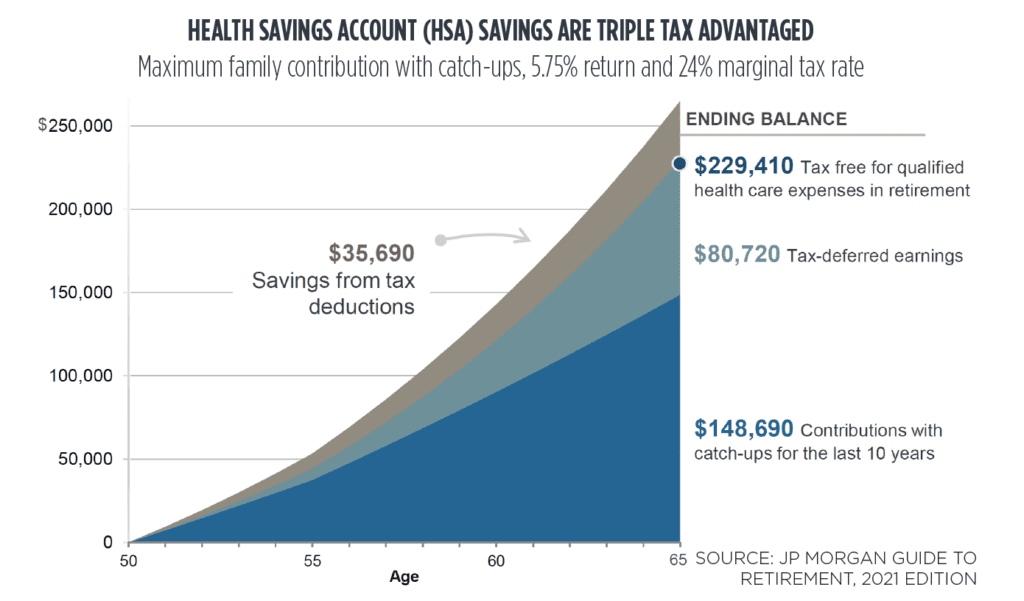

Utilizing a Health Savings Account (HSA) can be a tax-efficient way to save for health care costs in retirement. To qualify, you must be enrolled in a high-deductible health insurance plan as defined by the IRS, and as of 2021 you may contribute up to $3,600 as an individual or $7,200 as a family every year, with a $1,000 catch-up contribution limit for those over age 55. Your annual contribution limit is reduced by any contributions your employer makes to your HSA on your behalf. Once you are over age 65 and enrolled in Medicare, you can no longer contribute to an HSA, but you can use the funds in an HSA account for out-of-pocket medical expenses.

HSAs offer a triple tax advantage. First, contributions are tax-deductible. Second, all earnings are tax-free. And third, all withdrawals are tax-free, as long as the funds are used for qualified medical expenses. To illustrate how powerful this triple tax advantage is, assume an individual at the 24% marginal income tax rate contributes the maximum annual family contribution to an HSA for 15 years and earns a 5.75% return on the account. The individual will have contributed $148,690 over that time period and will have saved $35,690 in taxes by making these tax-deductible contributions (first tax advantage) and $80,720 in tax-deferred earnings (second tax advantage) and will have $229,410 in funds to pay for qualified health care expenses (third tax advantage).

Figure 4. Triple tax advantages of Health Savings Account. Adapted from ‘Guide to Retirement’ by JP Morgan, 2021 Edition.

Depending on where you open your HSA, you will have a variety of investment options. If you do not foresee using the funds in the near term, consider investing them for long-term growth to be used in retirement when your health care costs will be greater.

At all stages of life, it is important to understand your health insurance options to make sure you and your family are properly covered. Health care expenses should always be a part of your financial plan and budget; but they become even more important as you approach retirement, since they will take up a larger percentage of your budget as you age and employer coverage is no longer an option. As this note illustrates, there is no one-size-fits-all health insurance option, and the process of choosing and obtaining the right coverage for you can be complex. As always, we would be happy to assist you in your planning and connect you with the resources to help you make the best decisions for you and your situation.