Click on image at left for printer-friendly version…

Click on image at left for printer-friendly version…

By Joel S. Harris, CFA

Last month marked the fifth anniversary of a landmark event we would all rather forget: the ominous intraday low of 666 on the S&P 500 Index. It is also six years since the collapse of Bear Stearns, which set in motion a frightening series of events that nearly brought the global economy to its knees and triggered a liquidity-driven collapse in equity prices. For those days, we’re feeling anything but nostalgia!

Today, the S&P stands at 1,885, fully 175% higher than the dark days of 2009. To some extent, of course, these are just numbers. Stock prices and index levels alone offer no information about the most important consideration: equity valuations, in relation to the book value, cash flows or dividend streams of the underlying businesses. Nevertheless, calendar milestones such as these provide an opportunity for reflection. Should new record stock market highs be cause for celebration or concern – and what is the appropriate course of action now? What lessons could investors have learned from the extreme volatility of the past fifteen years? To address such questions, which naturally surface near potential inflection points, we find it useful to draw from our own experience.

Another Anniversary

Notably, 2014 also marks the 160th anniversary of the founding of H.M. Payson! As our readers can appreciate, we – and our clients – have navigated portfolios through periods of war, depression and too many stomach-turning market events. This history, along with the decades of collective experience and acumen of our research and portfolio management teams, provides a rare lens through which to assess the opportunities and risks facing investors today. Our longevity has instilled in us a deep appreciation for the resiliency of the capital markets, and an abiding respect for the role that equities can play in compounding and preserving wealth. Yet, as a fiduciary, H.M. Payson could not have survived and thrived for a century and a half without exercising vigilance for investment risk in all its forms.

Forecast Tools and the Track Record

As we have stated many times before: in the short term, price, or valuation, tells us little about where the market might go; but prevailing valuations can be a terrific predictor of subsequent, longer-term market returns. Among other inputs, we use assumptions for future valuations to produce and revise our forward-looking “expected returns[i]” for a variety of asset classes (stocks, bonds, and cash), based on the three building blocks of returns: yield, earnings growth, and changes in valuation. This exercise is extremely helpful to us in assessing the set of relative opportunities before us, and making tactical asset allocation adjustments to portfolios. Because we work with clients whose time horizons are generally long term, and because short term market movements are impossible to predict, we find five year return projections most relevant and useful. Although theoretical in nature and not necessarily great predictors of annual returns, these projections have proven useful, at least directionally – and particularly at market inflection points.

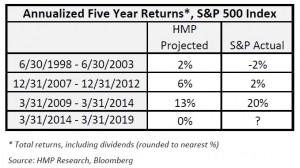

Several examples come to mind which we believe are instructive (see table above). In June of 1998, well before the peak of the “tech bubble”, our five year outlook reflected muted expectations of low, single-digit returns. This calculation was driven primarily by our view that valuations at the time would revert to meaningfully lower levels. Although our pessimistic view was scoffed at by many (who by that point had been conditioned to expect 20%+ annual returns), it actually turned out to be too optimistic! The S&P 500 produced average annual total returns (including dividends) of -1.8% for the next five years, and a mere 2.9% over a ten year span.

Several examples come to mind which we believe are instructive (see table above). In June of 1998, well before the peak of the “tech bubble”, our five year outlook reflected muted expectations of low, single-digit returns. This calculation was driven primarily by our view that valuations at the time would revert to meaningfully lower levels. Although our pessimistic view was scoffed at by many (who by that point had been conditioned to expect 20%+ annual returns), it actually turned out to be too optimistic! The S&P 500 produced average annual total returns (including dividends) of -1.8% for the next five years, and a mere 2.9% over a ten year span.

The current bull market, now celebrating the aforementioned fifth anniversary, has truly been the Rodney Dangerfield of market advances: doubted, denied, and disrespected by legions of prognosticators. In the depths of the financial crisis five years ago, optimists were scarcer than hockey fans at a curling match; but valuations were compelling and opportunities plentiful for disciplined and clear-headed investors. In the darkest hours of those painful few months, we saw the enormous opportunity developing as investor sentiment plummeted faster than stock prices. Our analysis concluded that the S&P might provide annualized five year percentage returns in the mid-teens. Our bullish outlook raised many eyebrows at the time – but has since proven to be far too conservative!

The Risks – and Mitigating Factors – Ahead

Although we were early in calling the lows in the interest rate super cycle, we now have plenty of company on the bond-hating side of the fence. However, the outlook for interest rates speaks to the biggest source of market uncertainty today: monetary policy. In our view, the unprecedented accommodative Fed policy (known as “Quantitative Easing”) has had a direct role in reflating asset prices. We are concerned about the fallout from the reversal of this policy, known as “Taper”. Obviously, a meaningful rise in interest rates could prove a negative for stock valuations. The best case scenario calls for earnings to continue to grow in a stable, even slow-growth economy that would not put too much upward pressure on interest rates.

Of course, we always find room for optimism – and believe every market environment offers pockets of opportunity. For example, the positive economic impacts of the modern US energy boom cannot be overstated, and it appears to be driving a manufacturing renaissance. As well, the housing recovery probably has more room to run, as household formation has outpaced new starts for several years now. Finally, if a market decline were to occur, we expect it to be less severe than the 2008-09 event since there is arguably too much liquidity sloshing around. At the corporate level, American companies are in the strongest financial condition in decades, with low debt and large cash reserves. Post the ’08 –’09 recession, corporations have continued to manage business with a lean and mean mindset, protecting profitability even with modest growth.

Current Outlook: A Low Return Environment

In general, the stock market appears overvalued by several measures (see H.M. Payson Research Note “Taking Shelter in Quality”, 1/27/14). Our latest five-year projected annualized returns for the S&P 500 – which, importantly, assume some reversion of high profit margins and lower valuations – is an uninspiring 0% return. Modeling future market returns has its limitations to be sure; so we don’t take our projections too literally. However, our models have been particularly effective around market inflection points. It is important to consider this outlook in relation to the wider opportunity set for other asset classes, also. As discouraging as our outlook is for the stock market generally, it is mathematically impossible for most bonds or cash to afford any inflation protection given their paltry yields.

Portfolio Implications

So, putting our dreary models and theories aside, what is our best portfolio solution today? We have been aggressively over-weight equities since stocks bottomed in February 2009; and only recently have we gradually reduced our equity exposure, depending on the individual client’s volatility tolerance. This equity orientation might appear incongruent with our cautious market outlook; but it is wholly consistent with our bottom-up, or stock specific, view of our investment opportunity set. We’ve often stated our view that there are good opportunities in any market environment. For the most part, we invest in individual equities, not an index. Yes, today’s high market valuations portend yet another risky time ahead for passively indexed equity portfolios. However, our portfolios are filled with stocks of high-quality companies possessed of strong balance sheets and healthy, compounding free cash flows. If not undervalued, we are generally very comfortable with the valuations of the individual positions within our clients’ portfolios.

Furthermore, not all markets have experienced S&P 500-like gains. In particular, the broad Emerging Market indices have under-performed the S&P by some 50% over two years. Our bet is that international equities could handily outperform the S&P in the coming few years. Our bond allocations are at minimum levels and our exposures conservative. On the other hand, we recommend clients reserve available portfolio cash now to fund two to three years of expenses, depending on client-specific factors. We also like the “optionality” of cash (see H.M. Payson Research Note “Hidden Value of Cash“, 4/3/12) as funds available to take advantage of opportunities that arise in a market correction.

Risk in Perspective

So, what are the lessons for investors from the past fifteen years? First, extreme valuations – whether high or low – matter a lot to long-term portfolio returns. Second, there is never an absolutely “safe” time to invest – but it is imperative to maintain adequate equity exposures for anyone who needs to protect purchasing power in the long run. No other asset class has come close to matching the inflation protection, liquidity and real income growth of stocks. Third, attempting to “time the market” is a counterproductive exercise in the long run, as we have stated many times before. Certainly, some times are better than others for stocks, but consider this hypothetical “worst case” example: if someone was unlucky enough to invest everything in the S&P 500 in October of 2007 (the absolute pre-crisis market peak), he or she would still have a 20% gain – plus a reliable and growing stream of income from dividends. Finally, we refer to our September 2013 Research Note, “The Hierarchy of Risks“, discussing the rank order of risks we face as investors. In most cases, market volatility is a far less important consideration than the risk of suffering the long-term, insipid and corrosive effects inflation has on a portfolio’s real spending power.

Volatility has a way of shaking the confidence of even the most experienced investors, and we have seen more than our share over the past fifteen years. But investors needn’t reflexively fear record highs in a stock or an index. With a proper perspective toward risk and an experienced, disciplined approach to asset allocation and security selection, investing in any environment can be a rewarding pursuit.

Market Log- April 1, 2014

S&P 500: 1,885.52

10 year T-Note: 2.76%

Crude Oil: $99.64

Gold: $1,279.90

[i] H.M. Payson expected returns are forward-looking statements based upon the analysis and beliefs of the H.M. Payson Research Department using current and historical relative valuations, assumed normal levels of sales growth, profit margins, dividend yields, spreads for fixed income, inflation, and other measures. These return expectations are estimates only, and not a guarantee of future performance. Actual results may vary widely from the return expectations above.

This commentary is prepared by H.M. Payson for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any security. The information contained herein is neither investment advice nor a legal opinion. The views expressed are those of H.M. Payson as of the date of publication of this report, and are subject to change at any time due to changes in market or economic conditions. The comments should not be construed as a recommendation of individual holdings or market sectors, but as an illustration of broader themes. H.M. Payson cannot assure that the type of investments discussed herein will outperform any other investment strategy in the future, nor can it guarantee that such investments will present the best or an attractive risk-adjusted investment in the future. Although information has been obtained from and is based upon sources H.M. Payson believes to be reliable, we do not guarantee its accuracy. There are no assurances that any predicted results will actually occur. Past performance is no guarantee of future results. Registration with the SEC or with any state securities authority does not imply a certain level of skill or training.

All Content © 2014 HM Payson

In the face of elevated stock market volatility, rising US-China trade tensions,…

Maine Huts & Trails provides outdoor excursions in beautiful Western Maine, boasting…