For printer-friendly version, click here.

By Chip Weickert, CFA; Chair, Portfolio Management Group

We were surprised to learn recently that for the first time in its history, the Fidelity mutual fund family now manages more bond assets than stocks. This historic shift reflects a massive, multi-year flow of funds out of stocks and into bonds as investors seek a safe haven from heightened global turmoil and equity market volatility. After a thirty year bull market in bonds, we fear that investors have forgotten the painful lessons of the 1970’s and have inadvertently exposed their portfolios to significant risks they might not understand.

Everyone knows interest rates have declined to generational lows, which has kept borrowing costs down and allowed homeowners and businesses alike to refinance existing debt. For savers and investors, however, it has been another story as shrinking yields on fixed income instruments have forced them to seek income from other asset classes. The enormous rally in the junk bond market, for example, reflects the scramble for yield as investors relax their quality standards.

Our primary concern, however, is the significant interest rate risk embodied in bonds today. Investors seem willing to accept little-to-no return on their capital. Like many investment management companies, we’re prepared to admit we were premature in calling the bottom of this interest rate cycle. However, we’re concerned investors are seeking “safety” in bonds, when the reality is bonds are extraordinarily expensive and therefore quite risky. Bonds are traditionally used to mitigate volatility. Today, however, bonds are not the “anchor to windward” most investors perceive them to be.

Based on the math of bond pricing, bonds are particularly sensitive to changes in interest rates when they are this low. Bond investors measure this sensitivity in terms of “duration,” which is a calculation that weighs the timing of all the cash flows from a bond investment. The longer a bond’s duration, the more the price of a bond will change with a change in interest rates. Today, record low cash flows from bond interest payments means most of the cash flow from a bond investment is the principal repayment when the bond matures.

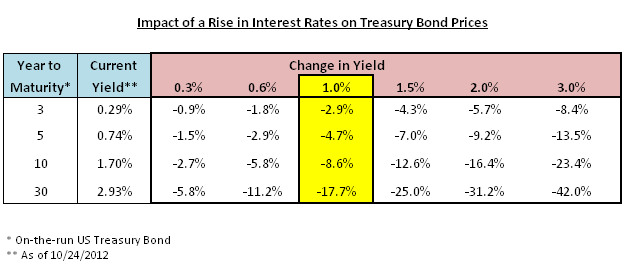

The table below shows the current interest rates on various U.S. Treasury debt maturities, and the price impact of some hypothetical changes in interest rates. It wouldn’t take much of an increase in rates for a bond’s value to decrease more than a year’s worth of income! More importantly, bond investors will suffer significant market losses should interest rates make a sustained move higher.

Again, it is difficult to predict when and why the long term downward trend of interest rates will change; but if global central banks continue to print vast quantities of money in their effort to stave off deflationary forces, it is not difficult to envision a return of inflation at some point. In fact, a few inflation indicators are already moving higher.

So what should investors do if they rely on their portfolios for income? As we have discussed in previous communications, dividend-paying stocks provide very competitive levels of income (in many cases, higher than bonds), and are far more reasonably priced, in our opinion. However, we have cautioned that some higher-yielding equities present their own set of risks (please see H.M. Payson Research Note: Not All Dividends Are Created Equal, October 4, 2012). From our perspective, the most effective strategy to protect against a gradual increase in inflation is to build a portfolio with carefully selected stocks that have a history and capability of increasing dividends over time. By focusing on sustainable businesses with strong balance sheets generating free cash flows, investors should be able to realize a rising stream of real income in the form of higher dividends.

Conclusion

The nature of bond investing has changed drastically as interest rates have declined to record lows. Over weighting bonds to mitigate portfolio volatility exposes unwitting investors to more risk, not less. In the current interest rate environment there are hidden and significant embedded price risks from owning bonds – particularly in longer-term bonds and bond funds. To the extent that a client’s investment policy requires at least a minimum exposure to fixed income instruments, we continue to keep maturities as short as possible to avoid these risks.

Market Log- October 26, 2012

S&P 500: 1,411.94

10 year T-Note: 1.75%

Crude Oil: $86.97

Gold: $1,711.00

If you have questions or comments regarding

this or any other Research Note, please email

the H.M. Payson & Co. Research Department

at hmpresearch@hmpayson.com.

One Portland Square – PO Box 31 – Portland ME 04112 – 207 772 3761

In the face of elevated stock market volatility, rising US-China trade tensions,…

Maine Huts & Trails provides outdoor excursions in beautiful Western Maine, boasting…