Since you can begin taking Social Security benefits any time between the ages of 62 and 70 (assuming you have worked long enough to qualify), this is a question we hear frequently.

The longer you wait, the higher your monthly benefits will be; but then again, social security is a ‘pay as you go’ system, not an account you can leave to your heirs. So in some cases, you’ll do better if you start collecting a lower amount at an earlier date.

What’s best for you will depend on your unique financial picture and the details of your life, including your life expectancy, spousal status, and assumed rate of return. As you make this personal decision, here are six considerations to keep in mind:

Regardless of when you start claiming benefits, Social Security won’t cover 100% of your prior earnings. It should be just one of many retirement planning factors, with others including portfolio allocation, budgeting, etc.

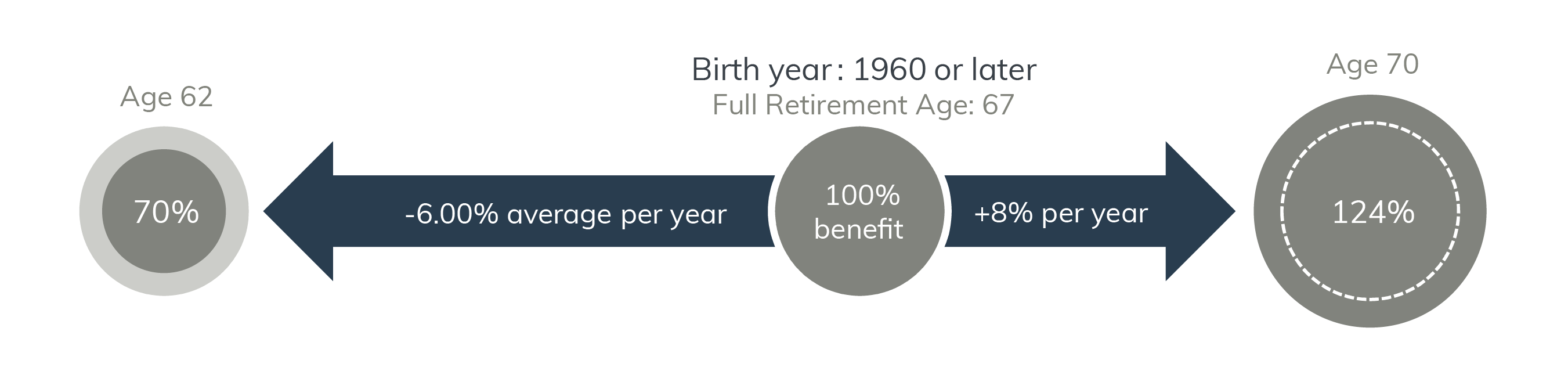

That’s almost double the amount. Your earnings record will determine your benefit amount at your ‘full retirement age’ (previously 65, but now between 66 and 67 years of age depending on when you were born). The graph below illustrates the decrease in benefits (-6% per year) for claiming early versus the increase in benefits (+8% per year) for delaying your claim.

Source: Social Security Administration, J.P. Morgan Asset Management

If you’re basing your decision strictly on life expectancy, the cost-benefit analysis of when to claim suggests that if you are going to die prior to age 76, claiming at age 62 is the best option; but if you’re going to live beyond age 80, claiming at 70 is best1. That said, if you wait until age 70 to collect benefits but stop working prior to then, you’ll likely need to fill the spending gap by drawing down your portfolio, which could otherwise be left to your heirs. So life expectancy isn’t everything.

1Source: Social Security Administration, J.P. Morgan Asset Management. Benefits are assumed to increase each year based on the Social Security Administration 2019 Trustee’s Report “intermediate” estimates (annual benefit increase 2.6%). Monthly amounts without the cost of living adjustments are: $1,873 at age 62; $2,898 at FRA; and $4,068 at age 70. Exact breakeven ages are 76 & 6 months and 80 & 5 months.

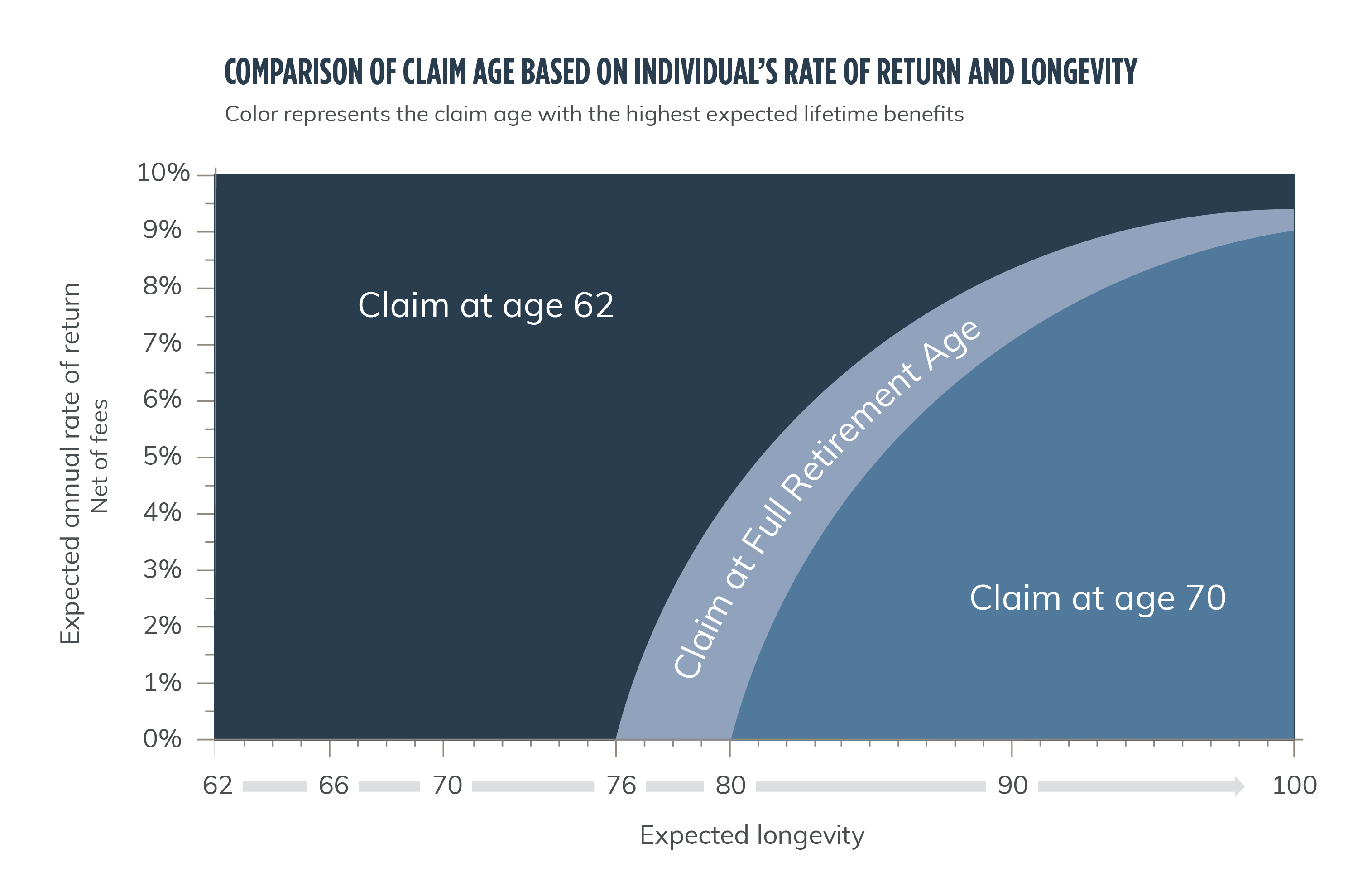

Retirees often wonder if it is worth taking benefits early and investing the income, with the idea that the market return could offset the decreased benefit. Whether this will be true depends upon two factors, both of which are nearly impossible to predict: your return assumption and your life expectancy.

As illustrated in the graph below, if you have a low expected long-term investment return and a longer life expectancy, it pays to wait; but if you have a higher expected return and shorter life expectancy, you should claim earlier and benefit from the higher return. To get an idea of where you might fall within this chart, look at your family history of longevity as well as some reasonable market return expectations.

Source (chart): Social Security Administration, J.P. Morgan Asset Management.

Source (longevity at age 62): Social Security Administration, Period Life Table, 2016 (published in 2019), J.P. Morgan Asset Management.

Source (expected returns): J.P. Morgan Asset Management Long-Term Capital Market Assumptions. Assumes the same individual, born in 1958, retires at the end of age 61 and claims at 62 & 1 month, 66 & 8 months and 70, respectively. Benefits are assumed to increase each year based on the Social Security Administration 2019 Trustee’s Report “intermediate” estimates (annual benefit increase of 2.6%). Expected rate of return is deterministic, in nominal terms, and net of fees.

Social Security also provides spousal benefits for those with insufficient earnings history to claim on their own work record. A spouse can choose to receive his or her own retirement benefit or half of his or her spouse’s benefit, whichever is greater. This applies to ex-spouses as well, provided that the marriage lasted at least 10 years and the ex-spouse claiming the benefit remains unmarried. In this case, spousal benefits are reduced if taken before the spouse’s full retirement age, but there is no credit for delaying benefits beyond full retirement age. If both spouses will be claiming on their own record, you can do survivor planning by having the spouse with the larger benefit delay, so that if that spouse is to predecease, their claim will be at its maximum for the surviving spouse. A couple with a few years’ age difference can maximize their cumulative lifetime benefits by having one spouse begin collecting at their full retirement age while the other delays until age 70.

If you look at when to draw social security benefits strictly from a cost-benefit model, you’ll probably never have enough data to feel sure you made the right decision. But by weighing other factors, most people find that the scale begins to tip. Ask yourself: Will you stop working prior to claiming benefits? Can you afford to draw down your portfolio in the meantime? Does your health or family history say anything about your life expectancy? And should you be planning around not just your benefits, but your spouse’s as well?

As always, we are happy to talk you through any of the questions above. Every client’s situation is different, and we would be more than happy to have a conversation about what social security might look like in the context of your specific retirement plan.

An update on the second round of sweeping legislative reforms