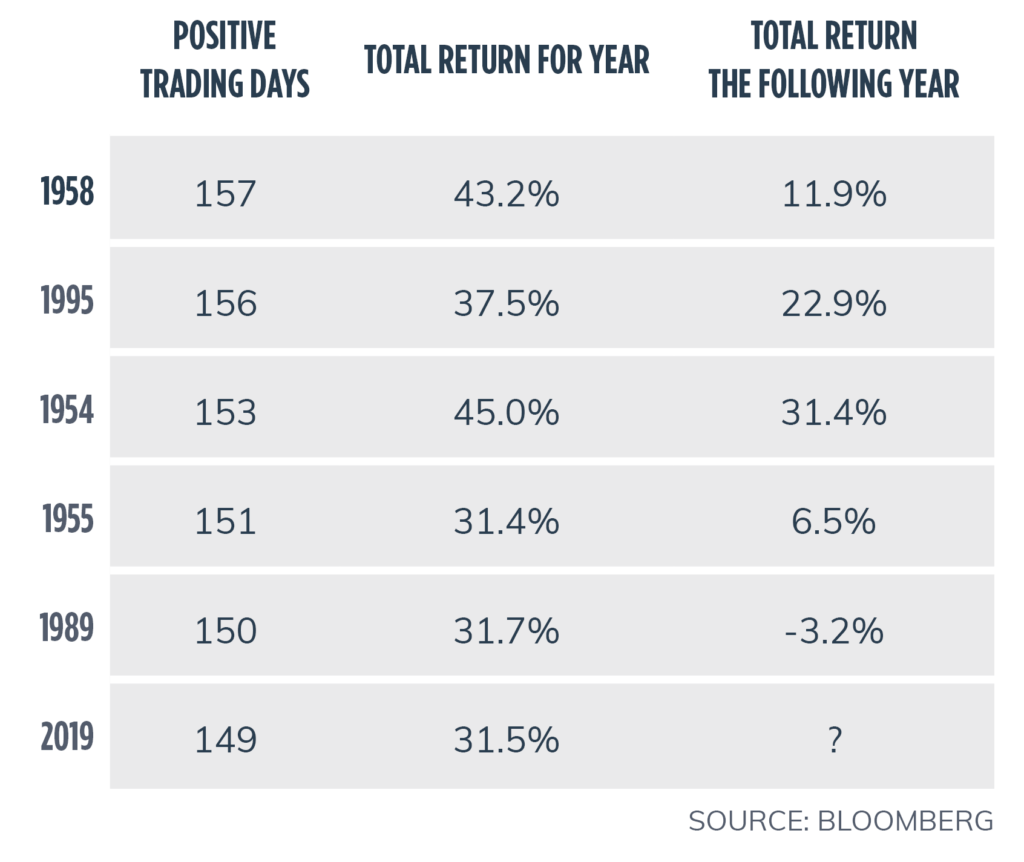

After finding coal in their stockings a year earlier, stock investors were rewarded in 2019 with very strong returns, capped off with a 4th quarter rally that was enjoyed around the globe. The U.S. stock market was at the top of the ‘nice’ list all year with international markets following close behind. Despite the unyielding stream of provocative headlines, 2019 was a remarkably smooth ride. In fact, the S&P 500 posted positive returns in 149 trading days in 2019, the sixth best tally since 1929.

Perhaps the most encouraging takeaway from the 4th quarter rally was broad participation. Accommodative monetary policy and improving economic conditions were the catalysts for higher stock prices across all major regions. The S&P 500 posted a solid 9.1% for the quarter, while International Developed Stocks (MSCI EAFE index) and Emerging Markets (MSCI EM Index) were up 8.2% and 11.7% respectively.

For context, the market started 2019 recovering from the sharp losses in December of 2018 when the Federal Reserve seemed intent on raising interest rates; so perhaps some part of the gain was retracing lost ground. As the Fed shifted policy and reduced rates in the second half of 2019, stocks gathered momentum.

While stock valuations might appear to be rich in certain industries and companies, overall, we believe the prices are reasonable in the context of a stable economic environment with low unemployment, low inflation, and low real interest rates. This is a powerful economic trifecta that is difficult to discount. If inflation stays muted and credit conditions remain accommodative around the world, our mosaic paints a positive year for equities in 2020.

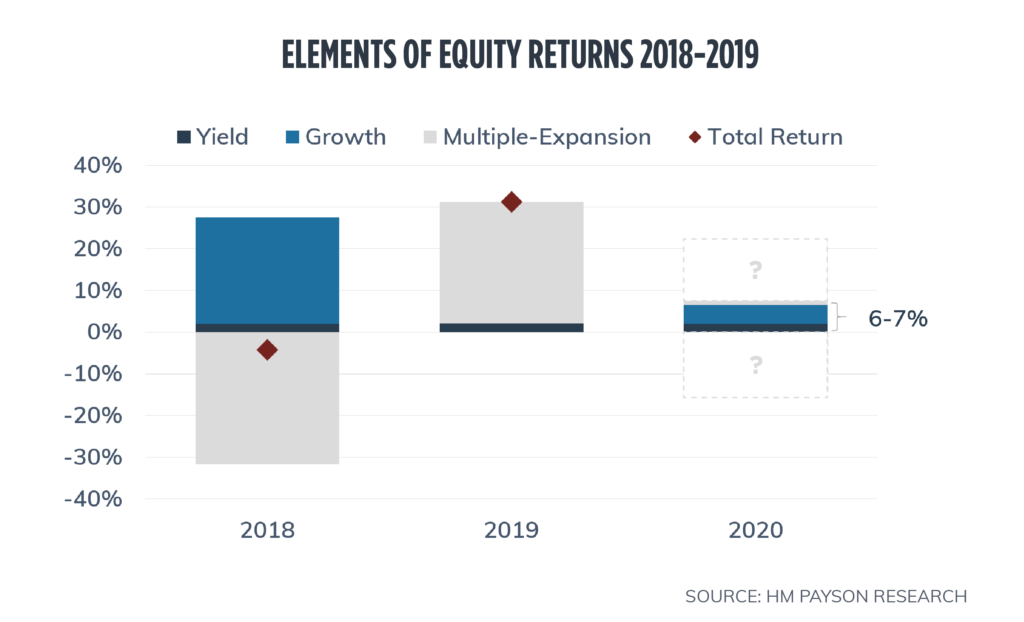

Still, after a year in which stocks returned over 30% it’s only natural to recalibrate the return equation looking ahead. Certainly, the elements of the S&P 500’s 2019 total return might give us extra pause: dividends provided a 2% return and earnings growth was essentially ZERO percent; but plain-old price appreciation of over 25% juiced the total return to the 5th best year in the last three decades.

In the context of 2018’s returns, however, 2019’s returns make a little more sense. Earnings growth in 2018 was a stellar 25% driven in large part by the effects of lower taxes and investment incentives engendered by the “Tax Cuts and Jobs Act” passed in December 2017. So, naturally in 2019 it was going to be tough to improve on 2018’s earnings. The price revaluation in 2019 was, in part, a reaction to the “all-clear” sounded by the Federal Reserve on the likelihood rates would remain unchanged for the foreseeable future. The return elements between the last two years look almost like a mirror image.

Looking ahead, we are encouraged by recent earnings surprises in the fourth quarter, as well as positive forward-looking earnings guidance from company managements. We estimate 2020 earnings-per-share growth in the 4%-5% range. With a current dividend yield around 2%, we therefore expect a ‘fundamental’ return of 6%-7%. Of course, price movement is the most volatile component of returns in the short term, and over the coming year we will carefully monitor markets to determine if earnings will support current valuations. Unfortunately, our view on the market appears to be aligned with the consensus, which gives us reason to be even more vigilant.

In addition to the favorable macro environment, the technical conditions also give us reason to be optimistic that momentum will carry over into 2020. The US stock market has a long and positive record of performing well after a third Federal Reserve rate cut, averaging 14% in the following year. It’s also worth considering that since 1982 the S&P 500 returned greater than 20% in a calendar year eleven times. The market provided a positive return the following year in eight of those instances – so we shouldn’t necessarily expect U.S. stocks to correct after a strong run in 2019. Finally, we are starting to see broad strength in areas of the market that have underperformed the blue-chip US stocks. International stocks and smaller U.S. stocks have kept pace in recent quarters, and we are actively looking for opportunities in these areas given the attractive valuations.

While the potential for disruption from beyond the market remains as prevalent as ever, 2019 was yet another reminder that investors need to remain focused on the fundamentals. We encourage clients to share their concerns and keep an appropriate reserve in cash and fixed income to cover near-term living expenses. But as long-term investors, our outlook for a disciplined approach to owning stocks is as strong as ever. Our goal is simple, but not easy: own companies with sustainable competitive advantages and take the long view. Importantly, we never attempt to “time” the market by moving in or out of stocks based on a short-term market outlook. The amazing power of compounding returns over time is the true source of market profits. As John Templeton, the legendary investor, was fond of saying, “the best time to invest is when you have the money!”

This newsletter is intended for educational purposes only. For financial planning advice specific to your needs or for further information, please consult your portfolio manager.