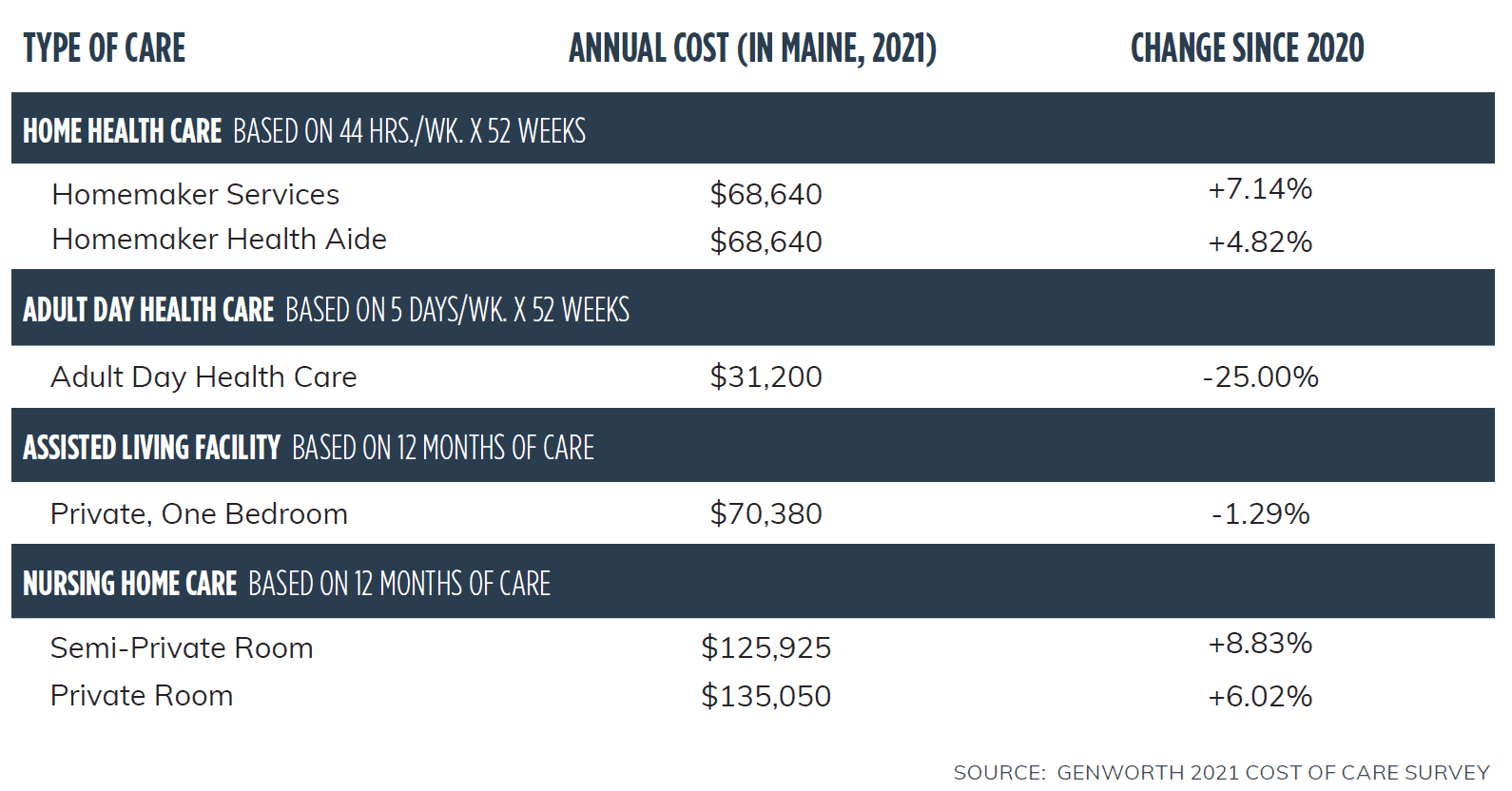

The medical definition of long-term care is “a facility that provides ongoing rehabilitative, restorative, and/or skilled nursing care to patients needing assistance with daily living activities.” When you’re enjoying your prime earning years, it’s hard to imagine that you would ever need assistance with daily life, nor is it something you probably want to think about. This could be why, even though most people eventually need it, and it’s a significant expense (a private nursing home room in Maine averages $135,050 per year), long-term care is the least planned-for retirement budget item.

The tendency to put it off could also be due to the fact that long-term care needs are highly individualized, and therefore planning for them can be confusing — there is no one formula that will work for everyone. You and your neighbor may be similarly situated, but if your priorities and risk tolerances differ, you could be best off taking vastly different tacks.

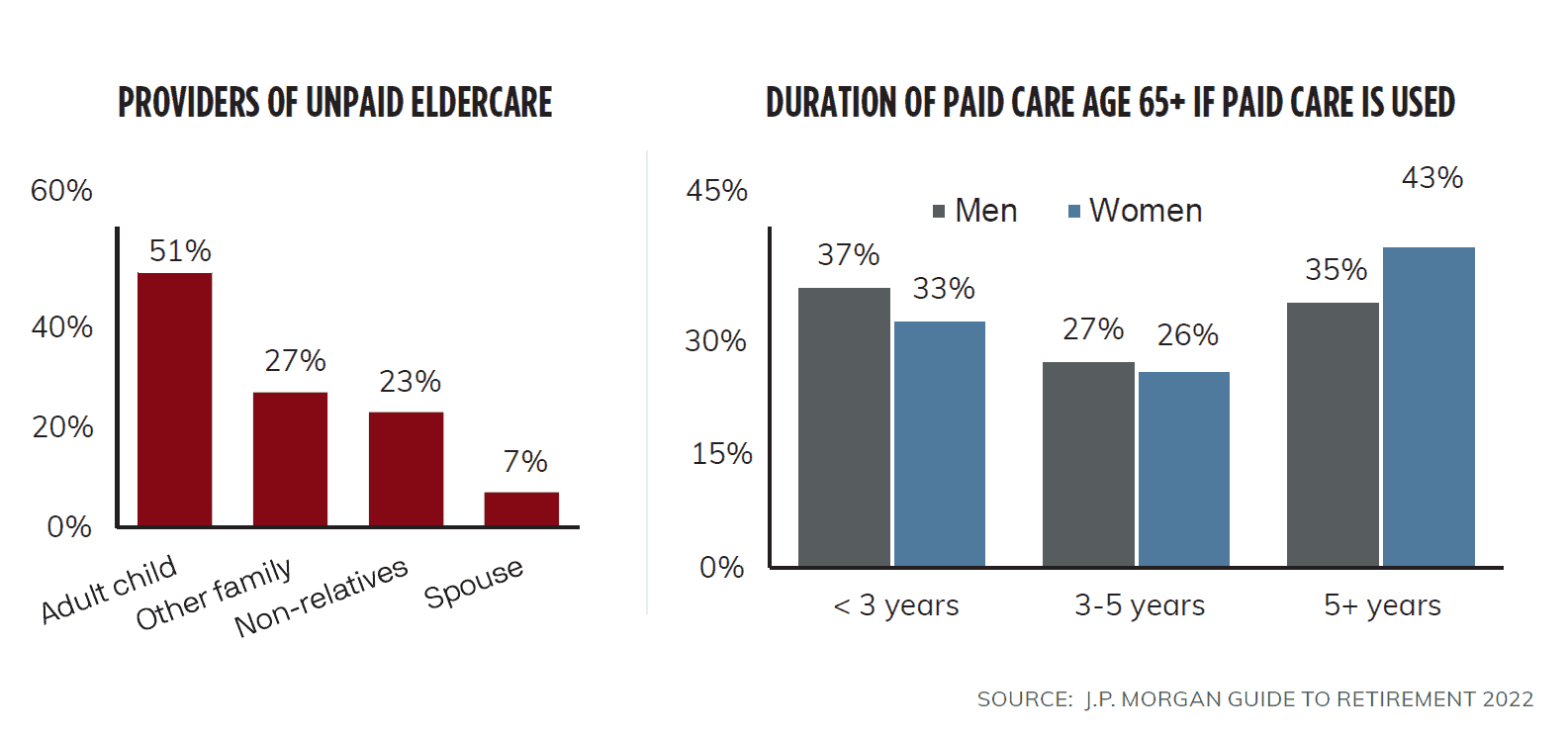

But you both should have a plan. Without one, the burden of caring for you will typically default to your closest family members, leaving them with some tough decisions and a potentially significant emotional and financial toll.

Every long-term care plan should address how care is funded, who is handling it, and in what setting it will be provided. On the financial side, thinking about the following five factors will set you on your way to the right plan for you:

Most of us will pay for long-term care out of our own assets; so the question isn’t where the money will come from, but rather if you should protect some of your assets from the cost of long-term care by purchasing long-term care insurance.

On one end of the spectrum are the people who have sufficient funds to cover all of their own needs, including those of their spouse. At the other end are individuals who will quickly exhaust their assets paying for care and will need to rely on government welfare. Neither group typically needs long-term care insurance.

But for those who fall in the middle (for example, individuals with enough assets to cover the cost of one spouse’s long-term care but potentially insufficient funds for the other spouse’s retirement and/or care), securing coverage to protect some assets can be a prudent option. Even for those without a spouse, long-term care insurance can be worth considering, given that it mitigates the risk of having to self-fund some or all of your long-term care.

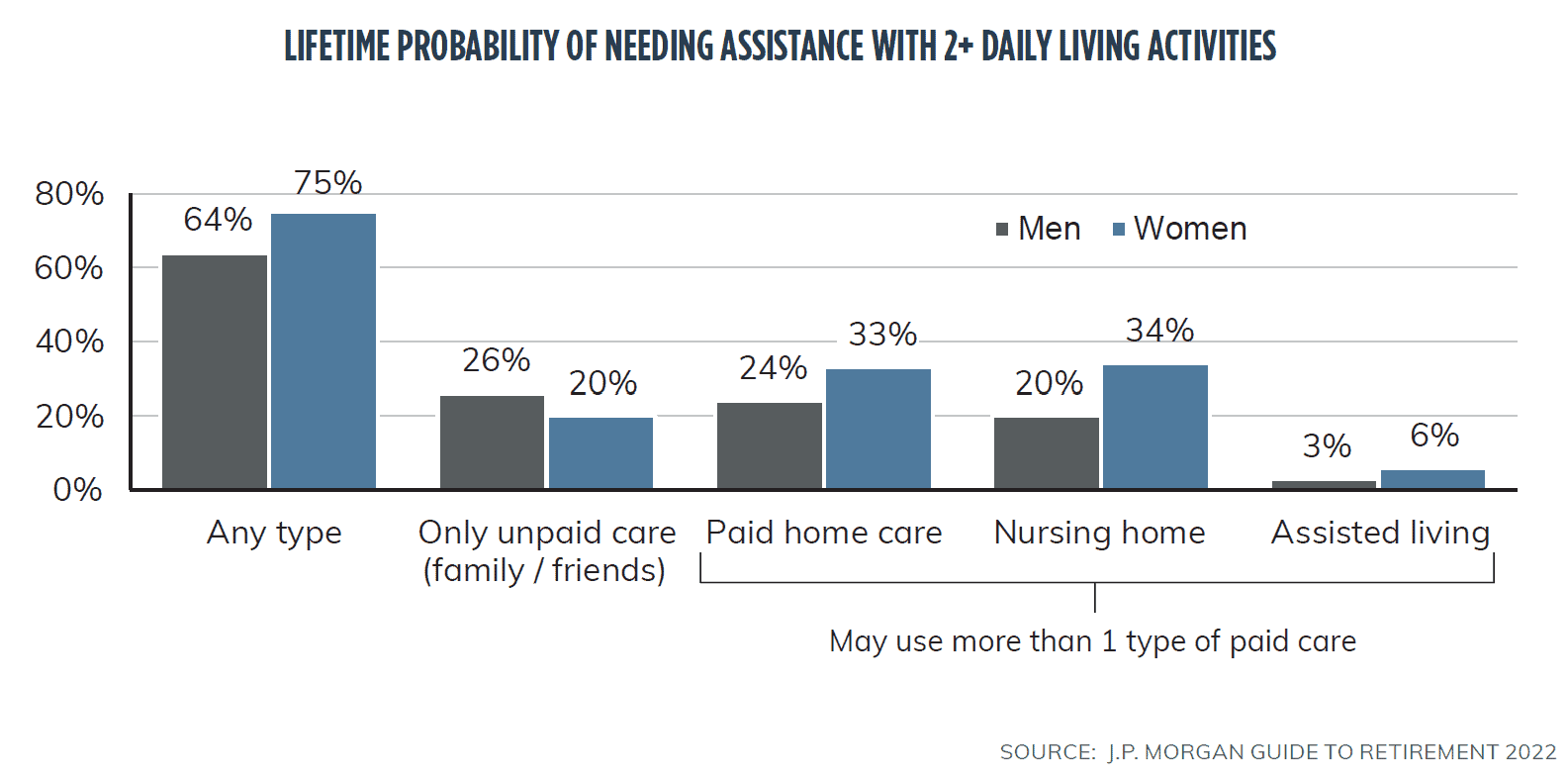

Even if you have assets that you ought to protect from the cost of long-term care, you still may not be able to say definitively that you need to buy a long-term care policy. While about 70% of us will use some form of long-term care, that still leaves 30% who won’t. And of those who use paid care, while the average man stays for 2.2 years and the average woman 3.7 years, many others only do so for a short period of time. Traditional long-term care insurance is “use it or lose it” coverage; so if you can’t tolerate the risk of not collecting any or all of a benefit after paying premiums for years, it may not be for you.

If you do choose to pursue long-term care insurance, qualifying may present some hurdles. The long-term care insurance industry has suffered from past actuarial missteps, leading some insurance companies to leave the industry and others to increase premiums and more strictly enforce eligibility criteria. All of this has made it more difficult to find and qualify (based on medical records, family history, etc.) for coverage. If you’re younger and in better health, you’ll secure lower premiums; but you’ll also pay them for a longer time period. Also, traditional long-term care insurance premiums aren’t fixed — so even if you do qualify for and purchase coverage, you’ll need to assume the risk of your premiums increasing over time (somewhat mitigating this risk is the notion that actuaries have had over 20 years to fix the mistakes of the past, the assumption being that they are now pricing the coverage properly).

While it is possible in some cases to cover the entire cost of long-term care with insurance, a more prudent approach for most people is to use this type of coverage as a supplement. Partially self-funding your long-term care expenses keeps premiums more affordable while also hedging against two outcomes most people would prefer to avoid: 1.) Fully funding a policy that you do not end up using, and 2.) Having to fully fund long-term care expenses out of your own assets.

Individual vs. Joint Insurance – Many couples wonder whether it makes sense to obtain joint coverage, or to favor insuring one spouse over the other. Our advice is typically to at least cover the spouse who will most likely need care first, potentially protecting existing assets for the other spouse’s retirement and care. If it’s unclear which spouse that might be, a joint policy can be a great, more affordable alternative to taking out two separate policies.

Hybrid Policies – A fairly recent development, hybrid life insurance/long-term care policies are an amalgamation of both insurance types. Premiums in the form of contributions tend to be materially higher; but they are fixed, and contributions that you do not use are refunded. If you can afford to fund this coverage, however, you might consider instead simply investing an equivalent amount in a safe yielding security and using the interest to pay the premiums of a traditional long-term care policy. That way, your principal will not be consumed by your care, and you’ll still receive long-term care benefits.

While no one can guarantee they’ll escape the expense of long-term care, everyone can at least have a plan. Start yours by defining how you expect your care to be funded, who should handle it, and in what setting you want it to happen. And be sure to discuss all of this with the people closest to you. If you need help with the financial side of the equation, we would be happy to provide you with our guidance. As stewards of multi-generational wealth for over 160 years, we are skilled at navigating the transition of financial assets, security, and well-being from one generation to the next.

This newsletter is intended for educational purposes only. For financial planning advice specific to your needs or for further information, please consult your portfolio manager.

An update on the second round of sweeping legislative reforms