In a story that will continue to unfold over many months and probably years, the period of late February into April, 2020, will go down in the annals of economic history as the most remarkable eight weeks we have ever experienced — with more volatility sure to follow.

In a story that will continue to unfold over many months and probably years, the period of late February into April, 2020, will go down in the annals of economic history as the most remarkable eight weeks we have ever experienced — with more volatility sure to follow. Certainly, many volumes will be written about this episode — but for our clients and our firm, so far the story has had an ironically positive twist: our thoughtful planning and asset allocation work, combined with our focus on quality investments, has produced exactly the results we would’ve expected, even if we could never have imagined any element of this surreal scenario.

Headed into the end of February the economy, employment, corporate earnings and the stock market were all strong and healthy with no obvious reason to believe the environment would change anytime soon. Along the way over the last year or so there had been occasional discussions about the possibility of a recession looming, but we saw no data to suggest the economy was slowing in the least. In fact, we were never more bullish in our outlook for corporate profitability and earnings coming into the year. We’re hopeful the economy can regain even a little of the incredible momentum it carried into this difficult period.

In a breathtaking and emotional timeline that is too familiar to us all, the virus’s actual and potential impact on economic activity grew parabolically along with global infection rates. Around the world, billions of daily micro-transactions which define our global economy simply stopped. Country after country implemented social isolation policies since containment and mitigation are the first chapter in the epidemiological playbook.

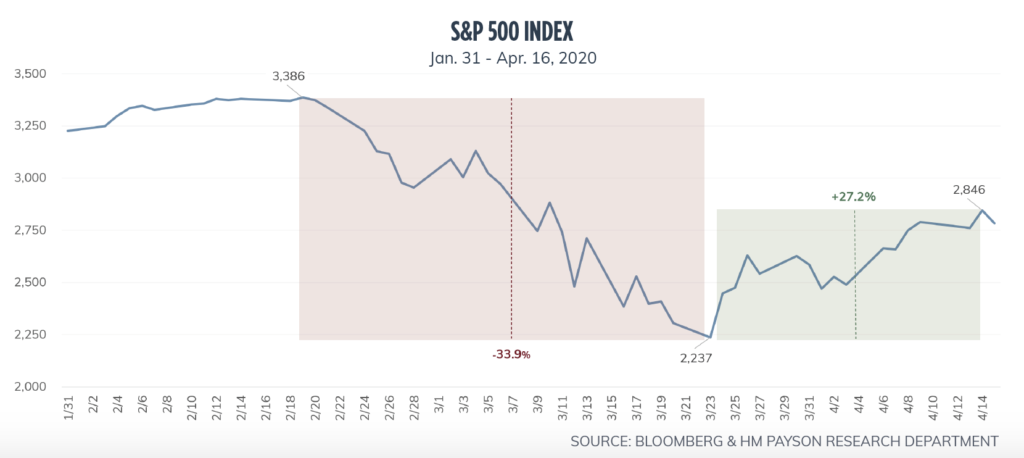

Very quickly, the markets priced in an imminent severe economic recession, the potential depths of which economists are still trying to grasp. Worse for the stock market than a sharp decline in earnings is the uncertainty of how low earnings can go and for how long. In a matter of those few weeks in March, in by far the fastest correction of its magnitude in the history of our stock market, the market was down almost 35% from its February 19th peak.

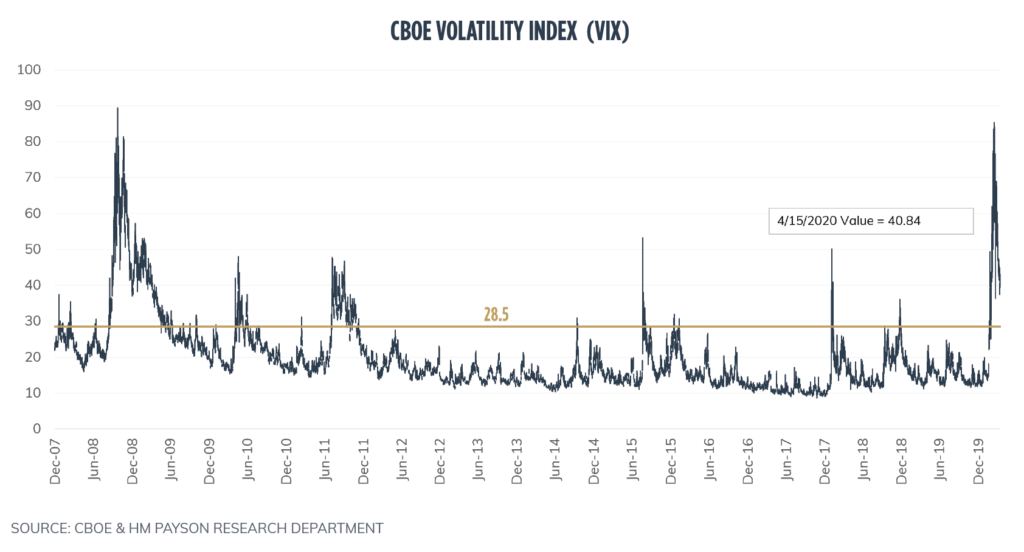

There is no way to overstate the dramatic extremes to which the panic selling drove the “risk metrics” for stocks and bonds globally during the first three weeks in March. The yield spreads of investment-grade corporate bonds exploded to record levels over risk-free US government debt — meaning investors demanded a much higher return for taking on any additional credit risk. In the stock market, the so-called “Fear Index,” or the VIX, which is mathematically derived from real-time stock option prices, skyrocketed to levels not seen since 2008. Historically, the good news is that looking ahead from these levels of quantifiable fear, market returns have been exceptional — and we did not believe this time would be different. Indeed, the market has staged a ragged but impressive rally of 24% off the lows, recouping 46% of the decline from the February highs. At least for now, we think it’s unlikely the market will test the March 23rd low. There were many factors at work in this rally; but maybe none more fundamental than the fear and uncertainty that led investors to drive prices down to such compelling and attractive valuations.

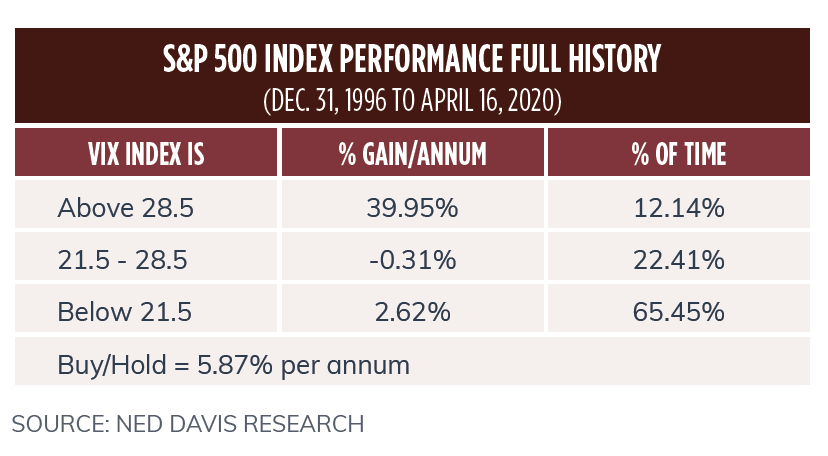

The evidence is clear: The best time to buy and own stocks is when others are fearful, to paraphrase the great Warren Buffett. As the accompanying table shows, when the Fear Index is over 28.5, subsequent market returns have averaged almost 40% per annum. The relatively good news, in this regard, is that after bouncing off a near-record 82 in March, the index still hovers around an elevated 45.

With some handholding on our part, our clients were able to observe this jarring volatility somewhat in the background of their investment lives. Depending on each client’s circumstances, we had made sure they had ample reserves to meet their spending needs well beyond the span of any market correction — even a correction as scary as this one. By design, our clients’ day-to-day budget needs from their portfolios were well insulated against this shocking market collapse, which has certainly helped them manage the psychological stress all of us naturally experience in these times.

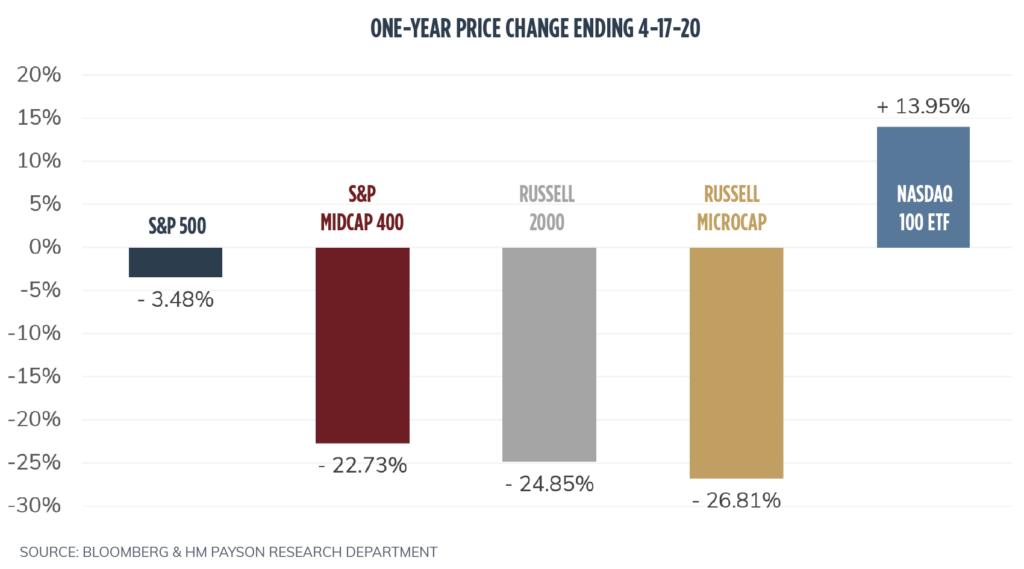

We have also found peace of mind in the very high quality of the companies in which we’ve invested, which have provided resilient portfolio performance as you might expect in the face of a difficult economic environment. As you might also expect, larger companies have outperformed smaller companies both on the way down and, so far, in the recent rally.

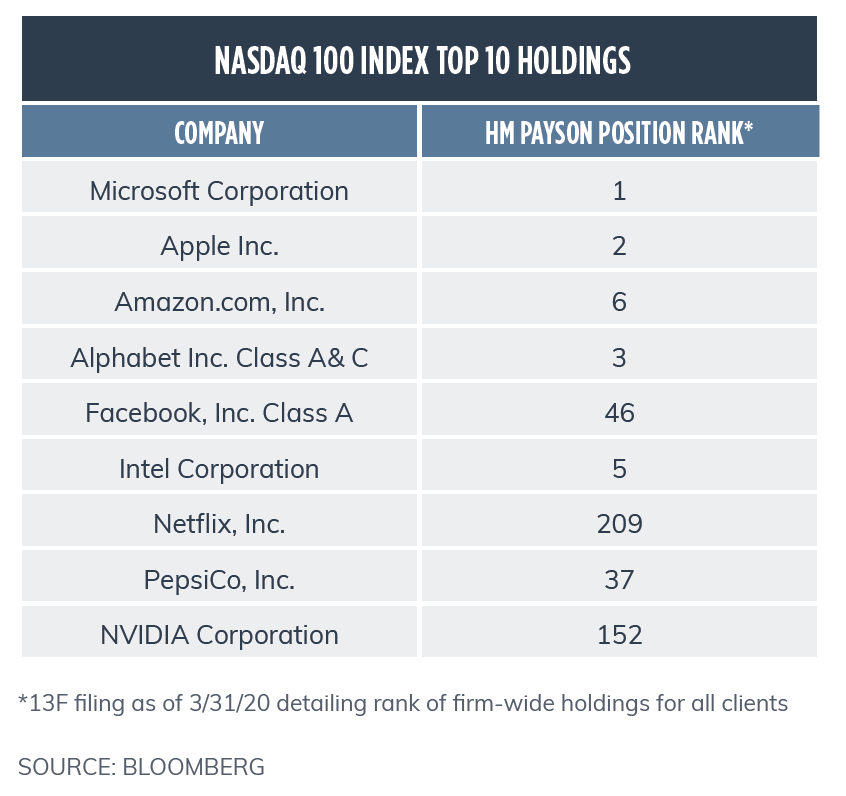

The NASDAQ 100 is an index of the largest 100 non-financial stocks listed on the NASDAQ system. As the graph illustrates, this index has far outperformed indexes of smaller companies and the S&P 500. We have significant holdings in some of the top constituents of the Nasdaq 100 which have been stalwart, bellwether performers in our portfolios through all of this.

We are certainly not sounding the ‘all-clear’ – far from it. This story has many more chapters ahead. However, for the most part, over the last several weeks we have taken the offensive in our equity portfolios. We have been finding stocks whose valuations we believe are weighed down by the ample economic uncertainty that still abounds, but which possess positive revenue and earnings leverage in an ultimate recovery – whatever that might look like.1

Timing is always the hardest part — which is why we don’t spend much time trying to guess “when”. In the short-term, we know anything can happen. However, today we do wonder if it’s possible the markets have come back too far and too fast — we’ll find out. In the meantime, we believe by laser-focusing on quality companies, able to invest in and fund their growth, the question of “when” becomes much less of an issue. We believe Growth remains the best defense against a cyclical economy since typically our companies generate plenty of free cash flow and will be less sensitive to interim economic volatility. Further, the companies we own for our clients typically have much less debt and better debt coverage than the average company — which, as debt has exploded, we think is likely to become an even more important distinguishing characteristic among companies we want to own longer-term.

Right now, we certainly see signs of stabilization — if not exactly a “recovery.” There are too many unknowns left – and the depth and duration of a decline in corporate earnings (and deteriorating balance sheets) are the things that matter most to the stock market. We all must brace for an avalanche of horrendous economic data, the likes of which we have never seen, which is sure to crest over the markets in the coming months. Today, we are questioning everything we think we know; and we are constantly re-examining our every assumption.

In investing, uncertainty is a powerful form of fear. Still, each new data point — good or bad, at the margin — brings into slightly better focus what lies directly ahead. This increasing clarity will slowly amortize the uncertainty hanging over the markets — which over time we believe shall inure to healthy valuations and more stable longer-term returns.

This newsletter is intended for educational purposes only. For financial planning advice specific to your needs or for further information, please consult your portfolio manager.

1 Importantly, we are circling back to our Feb. 28 note, in which we examined the high concentration of the S&P 500 index’s value in its top 5-6 names. Since publishing that note, this concentration has become even more pronounced.