The process of estate planning involves a family considering how they will pass wealth from an older generation to a younger generation while minimizing or eliminating estate taxes. While the transfer of wealth can happen as part of an estate plan that takes effect at death, it can also be advanced through gifts made during your lifetime.

Current tax laws allow a person to make annual gifts of up to $15,000 to as many individuals as they wish without such transfers being treated as gifts for gift tax purposes. The amount of the so-called “annual exclusion” is inflation-adjusted and increases periodically by $1,000 increments.

If you are fortunate enough to be able to make lifetime gifts, you will want to ensure that your family members are equipped to responsibly handle what they receive. This article gives an overview of lifetime giving and the important, related topic of next-generation financial literacy.

Lifetime giving has several benefits—some practical, others personal. On the practical side, a well-planned lifetime giving program can reduce the assets subject to estate tax by not only removing them from your estate, but also removing any appreciation that would occur if you were to hold them until death. On the personal side, the recipient of your gift may need the funds now more than they will in the future, and by giving now you will be able to see them reap the benefits.

Lifetime giving to younger family members such as grandchildren also presents an opportunity to start a conversation about financial literacy, which is the understanding of how to manage personal finances for a sound financial future. While financial literacy extends to many areas, we will focus here on two of the fundamentals: budgeting and saving.

Poor spending habits are one of the greatest threats to a person’s financial security. A budget can show you what your spending habits are, put you in control of them, and set you on a realistic path toward meeting your savings goals.

To get started, you first need to identify your current sources and uses of cash. Sources might include salary, social security, or portfolio income from dividends and interest. Uses include fixed expenses (mortgage payments, utilities, insurance, property taxes, healthcare, etc.) plus discretionary and lifestyle expenses.

To keep uses and sources aligned, you will need to identify your priorities in life and ensure that your spending reflects them. A standard budget guideline is the 50/20/30 ratio, with 50% of income going to essential living expenses, 20% to savings (15% to long-term goals and 5% to short-term goals), and 30% to discretionary spending such as dining out, travel, and entertainment. These target ratios may differ based on a person’s lifetime goals, earnings, or other circumstances.

Once you have a basic budget in place, you can use it to map out a long-term financial plan. Using projected income and spending habits, you can get an idea of how much you can save for retirement, what your estimated social security or pension benefits will be, and the age at which you will be able to comfortably retire.

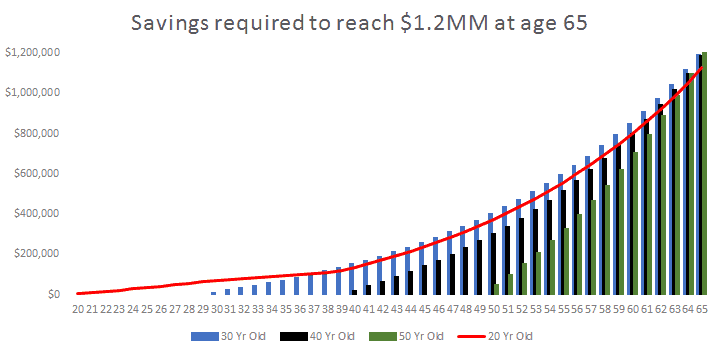

Another critical pillar of financial literacy is saving. Saving is the best way to prepare for lifetime financial goals such as retirement, buying a home, and sending children to college. The time you have between now and retirement is a valuable asset allowing investment returns to compound. The earlier a person starts to save, the better off they will be, as illustrated by the chart below.

For example, a 30-year-old who begins saving $10,000 a year, generating a 6% annual return, with plans to retire at age 65, will accumulate approximately $1.2 Million at retirement. Comparatively, if he does not begin saving until age 40, he must double the savings rate to $20,000/year to attain $1.2 Million by age 65. A 50-year-old must save $47,000/year to achieve the same results.

Lifetime giving to younger family members can be an excellent way to introduce the fundamental concepts of budgeting and saving early on, helping the next generation develop into financially secure and responsible adults who are not only well-equipped to manage their own assets, but also any assets they may inherit and pass along one day themselves.