It’s hard to escape clichés in our culture. These all-too-common sayings are intended to express a relatable sentiment or experience: All that glitters isn’t gold. Time heals all wounds. The calm before the storm. Laughter is the best medicine, etc. They provide a sense of empathy and comfort when faced with difficult circumstances or decisions. No surprise, the investment industry has been fertile ground for cultivating clichés. Buy low, sell high. Bulls make money, pigs get slaughtered. Never try to catch a falling knife. Don’t put all your eggs in one basket. The aim is to convey a sense of tried-and-true wisdom that can serve as a guiding principle. However, all clichés are based on generalities and stereotypes. They don’t offer specific guidance or reflect individual circumstances.

Unfortunately, many investment products and advice platforms are designed to promote efficiency by jump-starting the investment process through subjective risk tolerance questionnaires, rigid aged-based models, or even just simple rules of thumb. While these shortcuts may offer a framework for decision making and even a sense of comfort, they don’t address clients as individuals. Understanding the client’s specific financial profile, cash flows, and long-term goals should be the first step in the investment process and serve as the strategic foundation. The cornerstone of any long-term investment strategy is the asset allocation policy.

Asset allocation involves combining different asset classes to address the desired portfolio outcome. At the highest level, asset allocation could simply involve three asset classes: stocks, bonds, and cash. These three asset class categories are grouped separately because they have distinct properties, but also because they react differently in specific economic conditions. In practice, each asset class is further segmented into sub-asset classes. Stocks may be large companies or small companies, international or domestic, growth or value. Bonds may be divided by the issuer, government or corporate, as well as the country of domicile or credit quality.

Volumes of research have been written about asset allocation, and there are many ways to navigate toward a desired outcome. While these approaches may differ in their processes and goals, most seasoned investors and many academic studies would identify asset allocation as the primary driver of long-term portfolio returns. As such, it is important that the asset allocation process reflect the specific circumstances of each client and not rest on broad generalizations or assumed behaviors.

Like everything at HM Payson, our approach to asset allocation is centered around the client. We balance each client’s long-term growth objectives against their short-term liquidity needs. While addressing these dual goals, this decision framework remains grounded in common sense and historical market analysis and avoids opaque concepts like measuring “risk tolerance.”

Educating clients about different asset classes and market volatility are important facets of our relationship. However, we do not determine a client’s appropriate asset allocation by asking about their risk tolerance. Every client defines “risk tolerance” differently; so “what is your risk tolerance?” is simply the wrong question to ask.

Instead, we evaluate spending patterns and liquidity needs over the short and intermediate term. These inputs are easier to quantify and provide a mechanism to adapt the asset allocation over time as the client’s financial situation changes.

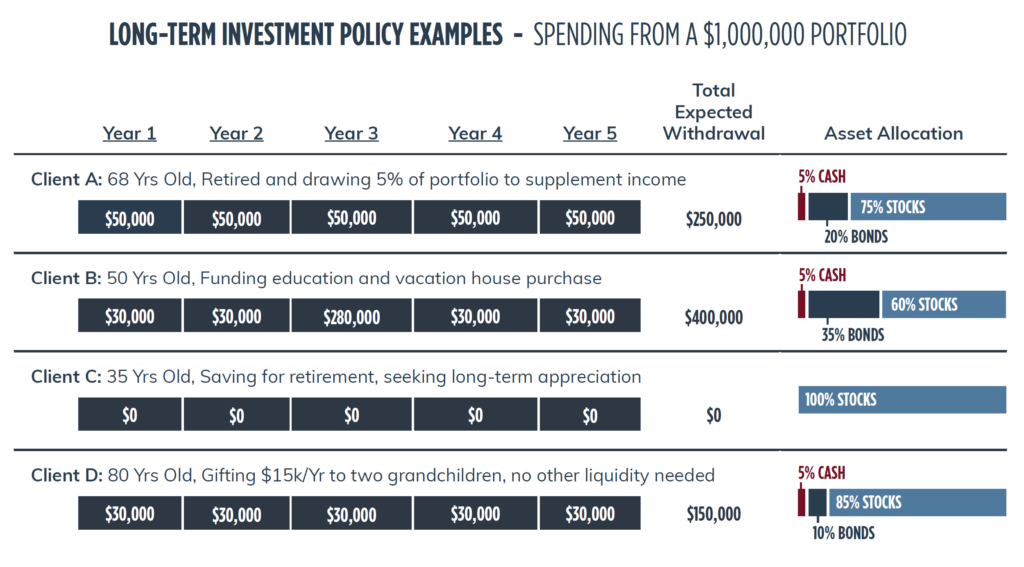

By identifying the client’s liquidity needs looking out 3-5 years, we can create a long-term investment policy that isolates and protects a portion of the portfolio to cover those withdrawals. In this way, we are adapting the client’s asset allocation to reflect their specific circumstances. The image below provides examples of this approach for four hypothetical clients of different ages and liquidity needs (note that the recommended allocation is a function of liquidity needs, not age or assumed tolerance for volatility).

The long-term investment policy seeks to match the client’s liquidity needs and long-term growth objectives with an appropriate asset allocation, striking a balance between short-term safety and long-term wealth accumulation. This liquidity-based asset allocation framework recognizes that stocks are inherently volatile, and that staying the course in the face of short-term volatility is critical to achieving long-term growth objectives.

We want to stick to the long-term strategy and avoid the temptation of “timing” the market by trading in and out of stocks. Attempting to time the market is a common pitfall that keeps investors from realizing their long-term goals.

In practice, to stay the course, an investor must 1) acknowledge their behavioral biases and adopt a framework that addresses those impulses if stock markets experience a sharp downturn; and 2) have the security of knowing that their short-term spending needs will be met.

The latter is why we always explicitly identify each client’s near-term spending needs and allocate a portion of the portfolio to meet them. In doing so, we help clients remain disciplined and non-emotional in the face of market volatility, minimizing the risk that

they will abandon their investment plan by selling equities at an inopportune time.

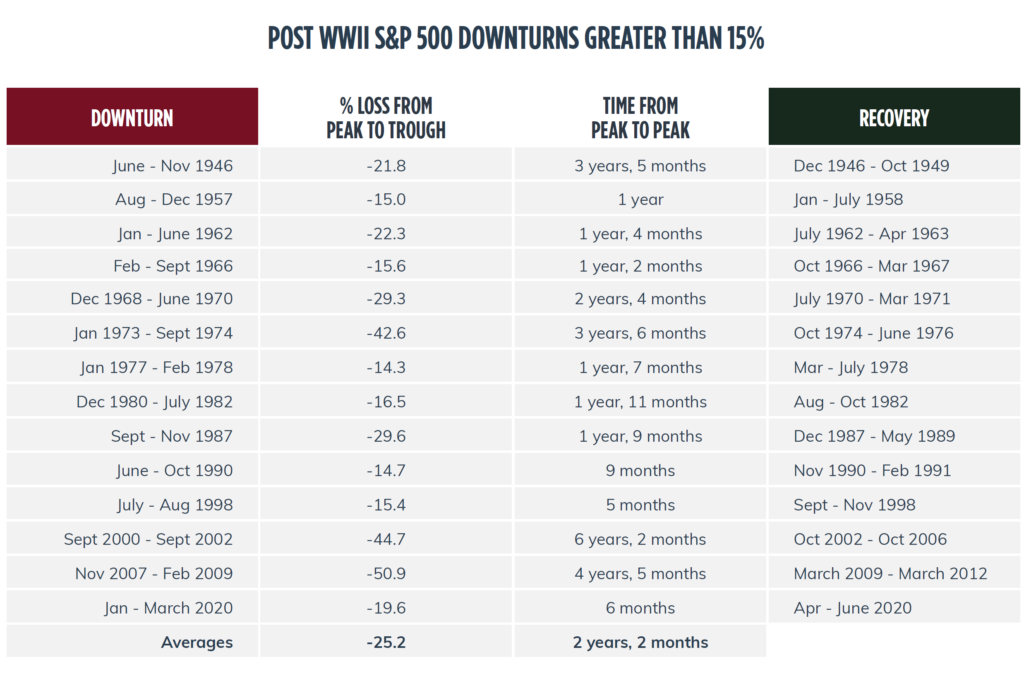

A review of historical stock market downturns offers some context regarding the frequency and duration of significant drawdowns, as well as the time needed to recover losses. The characteristics and causes of these downturns and recoveries differ; but the data suggests that a three- to five-year period is generally sufficient to ride out volatility.

The long-term investment policy is the first step in developing a client’s investment plan. It is the equivalent of charting a course in a sailboat before you leave the port. Once we set our course and leave the port, however, we know that things will not go perfectly to plan. The second step of our process is how we adjust our sails for the winds and currents of the open ocean.

The second part of our asset allocation decision framework is what we call “strategic equity allocation.” This process guides our decisions around which types of equities to include and the overall allocation size.

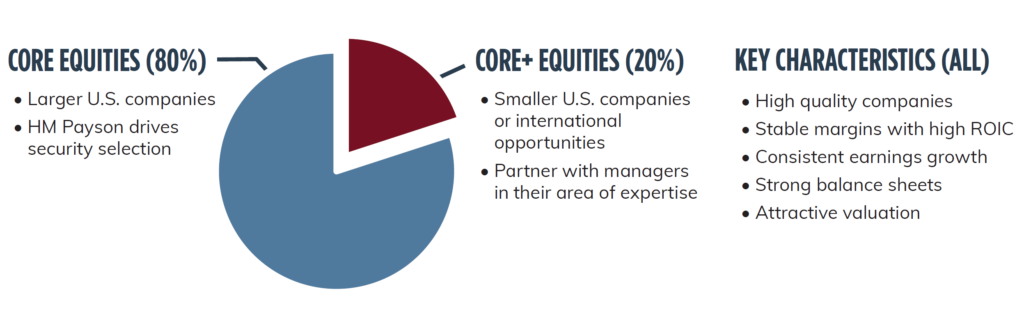

Because the global universe of public and private companies available for investment is massive and exceptionally difficult to effectively research and cover, HM Payson has a philosophy about what type of company represents a better long-term growth prospect.

Regardless of where these companies are in the world, how big they are, or if they are public or private, we are looking for the same key characteristics across our entire equity portfolio: high quality companies with stable margins, high returns on invested capital, consistent earnings growth, strong balance sheets, and attractive valuations. Such companies provide steady, consistent compound growth, a hallmark of HM Payson.

Our clients’ equity portfolios are allocated primarily to high quality, established U.S. companies, in part because most of our clients’ savings and spending is denominated in US dollars. Our internal team of research analysts has expertise in identifying these companies among the universe of large and mid-capitalization U.S. companies. We refer to these

holdings as the Core portfolio and we are constantly evaluating these opportunities.

For equity markets outside our core competency, such as small-cap stocks, international stocks, or private companies, we rigorously vet and partner with external specialty managers that share our philosophy and cultural values. We refer to these investments with specialty managers as the Core+ portion of the portfolio. As a condition of allocating to these external managers, we expect the Core+ investments to improve the overall characteristics of the total portfolio and generate superior long-term growth. If the Core large-cap U.S. holdings offer more attractive opportunities, we defer allocating assets to Core+ managers with inferior portfolio characteristics.

HM Payson adheres to a proven philosophy and process. We believe clients are best served by focusing on identifying quality businesses with superior long-term growth rather than trying to identify short-term macro-economic trends or changes to government policy.

Regardless of where companies are domiciled, how big they are, or how they raise their capital, we are trying to generate consistent long-term capital growth for our clients. This requires a disciplined, ‘bottom-up,’ long-term view. Forecasting macro-economic trends or currency movements is extremely difficult and often counterproductive to helping clients reach their objectives. Instead, our emphasis on fundamental characteristics keeps us focused on companies that should perform well at every stage of the economic cycle.

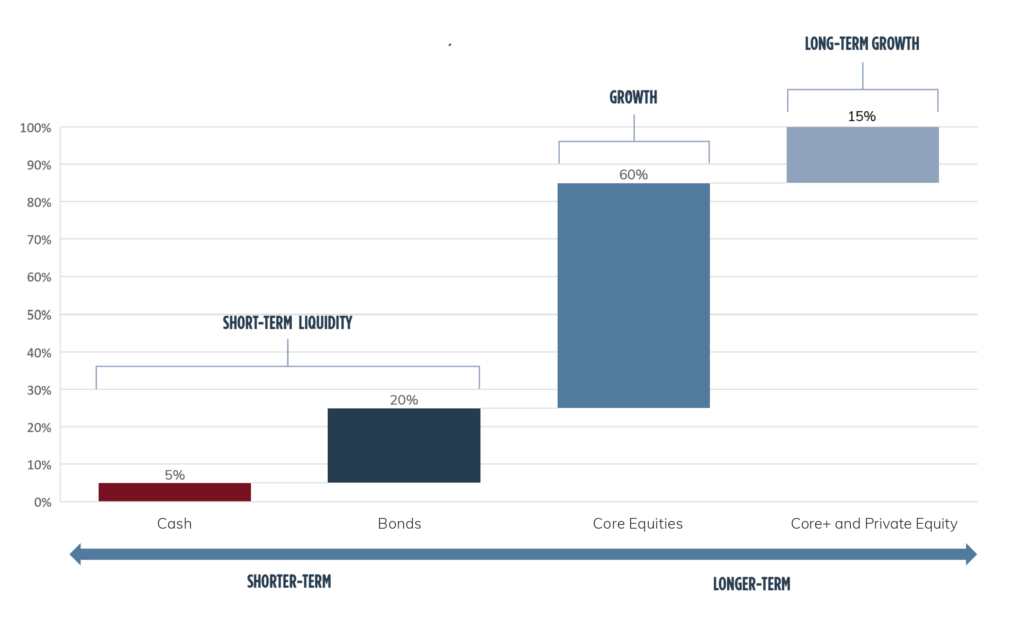

The last part of our framework is portfolio construction. Once out to sea, each sailor on a ship has a specific job to make the ship run efficiently. In that same way, we construct portfolios with the idea that each asset is there to do a specific job.

The graphic above provides an overview of our asset allocation framework. As opposed to a traditional pie chart representation of asset allocation, we explicitly tie certain assets to the time horizon for which they are intended.

For example, cash and bonds are intended to provide short- and intermediate-term liquidity to support spending over the next 3-5 years. The focus is to match the duration of the investments to the spending pattern.

Similarly, longer-term growth will come from the equity portfolio. The Core equity portfolio is intended to offer long-term growth, but also current dividends that will replenish the short-term liquidity. The Core+ equities are focused on long-term growth of capital that we expect will exceed the Core holdings and be an effective hedge against inflation. This is particularly true of HM Payson Private Equity investments, as many of these companies are in the nascent stages of development. Each asset plays a specific role in this time-horizon dependent framework, and our goal is to select the best asset to accomplish each job.

Investing is a journey, and that journey requires planning. We believe any investment plan should start with the individual client and rest on a commonsense framework that can be consistently applied. While the framework should be easy to understand, it should not be cliché or attempt to segment investors according to arbitrary criteria. Our framework

offers clients stability when faced with market storms, but also forward momentum to reach their destination. HM Payson has guided clients for 166 years, and while it may sound like a cliché, each journey is unique.