Buy low and sell high. It’s a simple concept and one of the most basic, well-known tenets of investing. And yet, it’s equally well known that most people end up buying high and selling low.

Nobel Prize-winning economics professors and behavioral finance experts have analyzed this paradox in great depth. To summarize their various conclusions, humans are psychologically wired with certain cognitive obstructions that prevent them from acting rationally when making investment decisions. Read on for more details on what these obstructions are, as well as some of the safeguards we put in place at HM Payson to keep emotional decision-making from disrupting your long-term plans.

The herd instinct, also known as herding, is the act of abandoning individual, independent thought or introspection in favor of following the behavior of others (the herd).

The herd instinct can be beneficial in certain circumstances – it’s what causes a person to join a crowd running out of a burning building even if they can’t personally see or smell the fire; but when it comes to investing, this instinct is notoriously counterproductive.

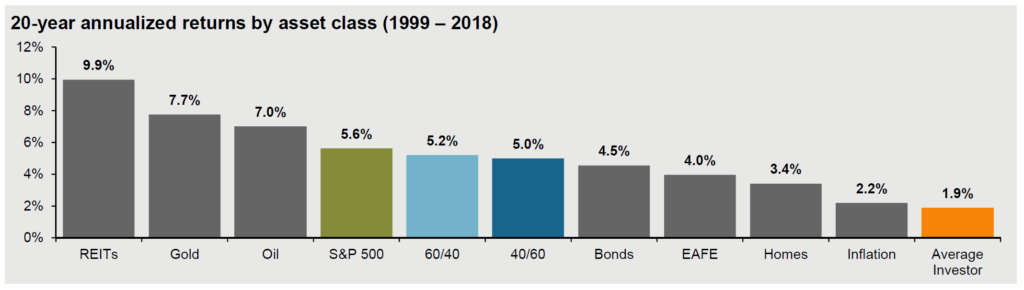

The chart below illustrates just how poorly the herd fared over the last 20 years compared to other common indexes and asset classes. This data tracks the monthly buys, sells, and exchanges of mutual funds and represents the average investor’s behavior and overall investment experience over the last two decades. At the end of 2018, average investors exited the market, but not early enough to avoid losses; and then they remained out of the market during the recovery months – making their 20-year performance even worse than inflation.

Source: J.P. Morgan Asset Management; Dalbar Inc *

Not surprisingly, most investors are more comfortable when asset prices are high and considerably less so when asset prices are low. Anxiety and stress levels rise during periods of uncertainty; and in a stressed emotional state, a person’s ability to make rational decisions is meaningfully impaired.

Volatility is another significant cause of anxiety for investors. Short-term swings in the market can hinder a person’s ability to remain focused on the long term. Rationally, most people know that the market doesn’t go up every day and that volatility is part of having money invested in equities; but recency bias (and with it, loss aversion) still causes people to focus intensely on current headlines.

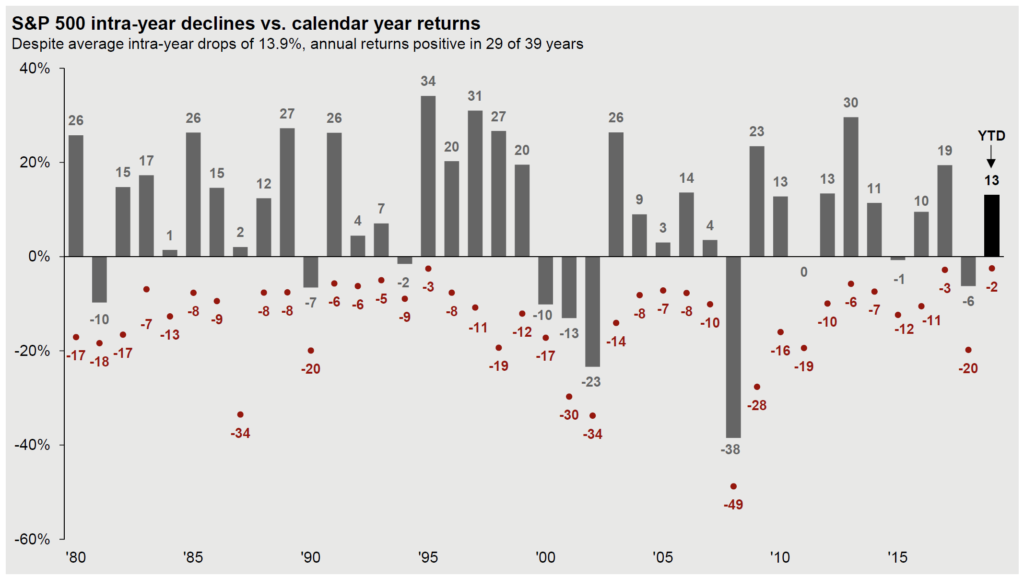

The chart below shows just how common volatility and significant intra-year market swings have been, all the way back to 1980. On average, the S&P 500 has had a decline from peak to trough of almost 14% each year, yet the market finished the year in positive territory nearly 75% of the time.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management.**

There are many ways to prevent emotional decision-making from disrupting your financial plans. The most important is to remember that anxiety during turbulent market stretches is common and natural, and not something you need to act on. Other effective tools to keep investment-related emotions at bay include:

The Investment Policy Statement (IPS) — This document clearly lays out the purpose and overall goals of your investments including asset allocation parameters, time horizon, and risk tolerance levels, as well as how these factors fit in with your overall financial picture. By periodically updating your IPS together, we always have an objective, up-to-date guide for any meaningful portfolio adjustments.

A Long-Term Focus — Focusing on timeframes beyond the current noise of the market can be difficult, but it’s well worth the effort. Reviewing your IPS can reinforce this frame of mind, serving as a reminder to be patient and resist the urge to reactively tinker with investments during short-term fluctuations.

Diversification — A well-diversified portfolio with non-correlated asset classes can help reduce volatility and the emotions that come with it. Everyone’s overall allocation is different, and is based on risk tolerance, required rate of return, and liquidity needs.

Liquidity — Having a cushion of enough cash and/or short-term bonds to cover living expenses for at least 3 to 5 years can provide a sense of comfort during turbulent times and prevent you from ever having to sell high-quality stocks at depressed values to cover current expenses.

* Chart 1: J.P. Morgan Asset Management; Dalbar Inc. Indices used are as follows: REITS: NAREIT Equity REIT Index, EAFE: MSCI EAFE, Oil: WTI Index, Bonds: Bloomberg Barclays U.S. Aggregate Index, Homes: median sale price of existing single-family homes, Gold: USD/troy oz., Inflation: CPI. 60/40: A balanced portfolio with 60% invested in S&P 500 Index and 40% invested in high-quality U.S. fixed income, represented by the Bloomberg Barclays U.S. Aggregate Index. The portfolio is rebalanced annually. Average asset allocation investor return is based on an analysis by Dalbar Inc., which utilizes the net of aggregate mutual fund sales, redemptions and exchanges each month as a measure of investor behavior. Returns are annualized (and total return where applicable) and represent the 20-year period ending 12/31/18 to match Dalbar’s most recent analysis. Guide to the Markets – U.S. Data are as of March 31, 2019.

** Chart 2: Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to 2018, over which time period the average annual return was 8.4%. Guide to the Markets – U.S. Data are as of March 31, 2019.

In the face of elevated stock market volatility, rising US-China trade tensions,…

Maine Huts & Trails provides outdoor excursions in beautiful Western Maine, boasting…