Click on the image at left for printer-friendly version…

Click on the image at left for printer-friendly version…

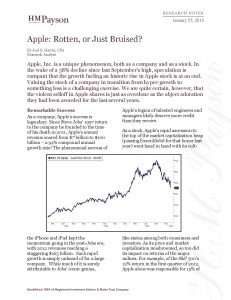

Apple, Inc. is a unique phenomenon, both as a company and as a stock. In the wake of a 38% decline since last September’s high, speculation is rampant that the growth fueling an historic rise in Apple stock is at an end. Valuing the stock of a company in transition from hyper-growth to something less is a challenging exercise. We are quite certain, however, that the violent selloff in Apple shares is just as overdone as the abject adoration they had been awarded for the last several years.

Remarkable Success

As a company, Apple’s success is legendary. Since Steve Jobs’ 1997 return to the company he founded to the time of his death in 2011, Apple’s annual revenue soared from $7 billion to $100 billion – a 94% compound annual growth rate! The phenomenal success of the iPhone and iPad kept the momentum going in the post-Jobs era, with 2012 revenues reaching a staggering $165 billion. Such rapid growth is simply unheard of for a large company. While much of it is surely attributable to Jobs’ iconic genius, Apple’s legion of talented engineers and managers likely deserve more credit than they receive.

As a stock, Apple’s rapid ascension to the top of the market capitalization heap (passing ExxonMobil for that honor last year) went hand in hand with its cult-like status among both consumers and investors. As its price and market capitalization mushroomed, so too did its impact on returns of the major indices. For example, of the S&P 500’s 12% return in the first quarter of 2012, Apple alone was responsible for 15% of that advance. At its zenith, it became the most widely held stock among mutual funds and hedge funds, particularly those with a “growth” or “momentum” bent. Managers who aspired to keep up with the index simply had to own AAPL, or so they thought.

Love/Hate

It is difficult to recall any stock that has flipped from “most loved” to “most hated” status in such a short period of time, and it leaves investors of all stripes wondering about the growth prospects of the Apple franchise. Thursday’s 12% decline in response to a disappointing quarterly earnings release is just the latest in a series of events that have raised increasing concerns about the Company’s growth rate and enviable profit margins – both critical elements in valuing the shares. We will not bore our readers with the details of the earnings release here, but suffice to say both the pace and rate of the decline in both metrics implied by recent results has taken many investors by surprise.

Investors wondering what to do with Apple shares might opt for a fundamental approach, parsing recent earnings data, media reports and blogs in an attempt to gauge future demand for Apple’s products in an increasingly competitive environment and global economy. Since postulations about that sort of information are widely available, we prefer to focus on the valuation, and interpret what that is telling us about the assumptions embodied in the stock price today.

What the Stock Price Implies

At today’s price of $450, AAPL’s ratio of price to earnings is about 10x – a 35% discount to the multiple for the S&P 500. Its dividend yield is 2.3% – better than the S&P’s 2.1%. Price to free cash flow is a meager 10x. These are very modest multiples for a company that has enjoyed such rapid – and profitable – growth. Apple’s profitability is another important component of its valuation. Measures such as Return on Equity (40%+), Operating Margins (~35%), and Net Profit Margins (25%+) have been the envy of the technology industry (any industry, for that matter) for years.

Using a discounted cash flow methodology, we can use these metrics and other inputs to produce a range of intrinsic values for Apple. We won’t go through the calculations here, but can say that at its current price Apple shares appear to embody some unrealistically harsh assumptions about the Company’s future prospects – more specifically, zero growth and a Return on Equity of 10% (1/3 of its current level). These drastic declines seem unlikely in view of Apple’s recent fundamental performance. As we have said many times before, predicting growth rates for any company can be dangerous, and thus we prefer not to pay for it – but that does not appear to be a risk with Apple at current prices. So what do we think the shares are worth? Using a range of conservative-to-realistic inputs given the company’s strong market position and potential opportunities, we can produce anything from $600 to $700 per share without going too far out on a limb. Depending on when the stock might recover to such levels, this implies a very healthy return from here.

Show Us the Money

In our opinion, management could play a decisive role in turning the stock around by announcing its intention to return much more of its enormous cash reserves to shareholders. Apple’s profitability and scale translates to abundant free cash flow; in 2012 alone, the company generated $40 billion. With approximately $137 billion in cash on the balance sheet, management could comfortably double the dividend and repurchase 10% (or more, over time) of the shares outstanding. Such a move would broaden the investor base and boost earnings per share even if growth slows to a crawl.

Opportunity Knocks

In conclusion: while it may be some time before Apple shares see $700 again (if ever), $450 represents an unduly pessimistic outlook for the Company’s future prospects. Nevertheless, in this business it is axiomatic and worth remembering that in the short run any stock is worth only what the market is willing to pay for it – and Apple is no exception. No amount of rigorous intrinsic value work can overcome the fact that investors have lost confidence in the company’s ability to produce outsized growth quarter after quarter. Consequently, Apple is in the midst of a painful transitioning of its shareholder base from “growth” to “value” investors, which will take time. Despite the horrible sentiment around the stock today, we believe Apple offers a compelling investment opportunity today – but patience may be required after such a bruising.

Market Log- January 24, 2013

S&P 500: 1,500.57

10 year T-Note: 1.92%

Crude Oil: $95.93

Gold: $1,659.80

If you have questions or comments regarding this or any other communication from us, please email us at hmpresearch@hmpayson.com.

In the face of elevated stock market volatility, rising US-China trade tensions,…

Maine Huts & Trails provides outdoor excursions in beautiful Western Maine, boasting…