Warren Buffett has described his investment approach as looking for “economic castles protected by unbreachable ‘moats’.” His metaphor evokes images of soaring walls and towers with grandeur and scale, ruled by wise kings with unassailable power. We only need look to our own portfolios for examples: Apple, Amazon, Microsoft, and Visa. These are companies with fortress-like balance sheets that are reinforced with strong free cash flow and dominant competitive positions. They have management teams who think strategically, drive innovation, and deploy capital with discipline, increasing profit margins and widening their moats.

These economic castles are, and will remain, at the heart of our portfolio construction, but not all castles are big. A small castle can have all the characteristics of a large castle, with more capacity to grow.

There are roughly 5000 companies listed on US stock exchanges. Yet the indices most often quoted to gauge changes in the ‘stock market’ are made up of a small portion of those names. The Dow Jones Index is composed of just 30 stocks. As the name would suggest, the S&P 500 Index is made up of 500 stocks. Why do we place so much emphasis on these indices when reporting changes to the stock market? It comes down to the territory these large castles command; or said differently, their total market capitalization.

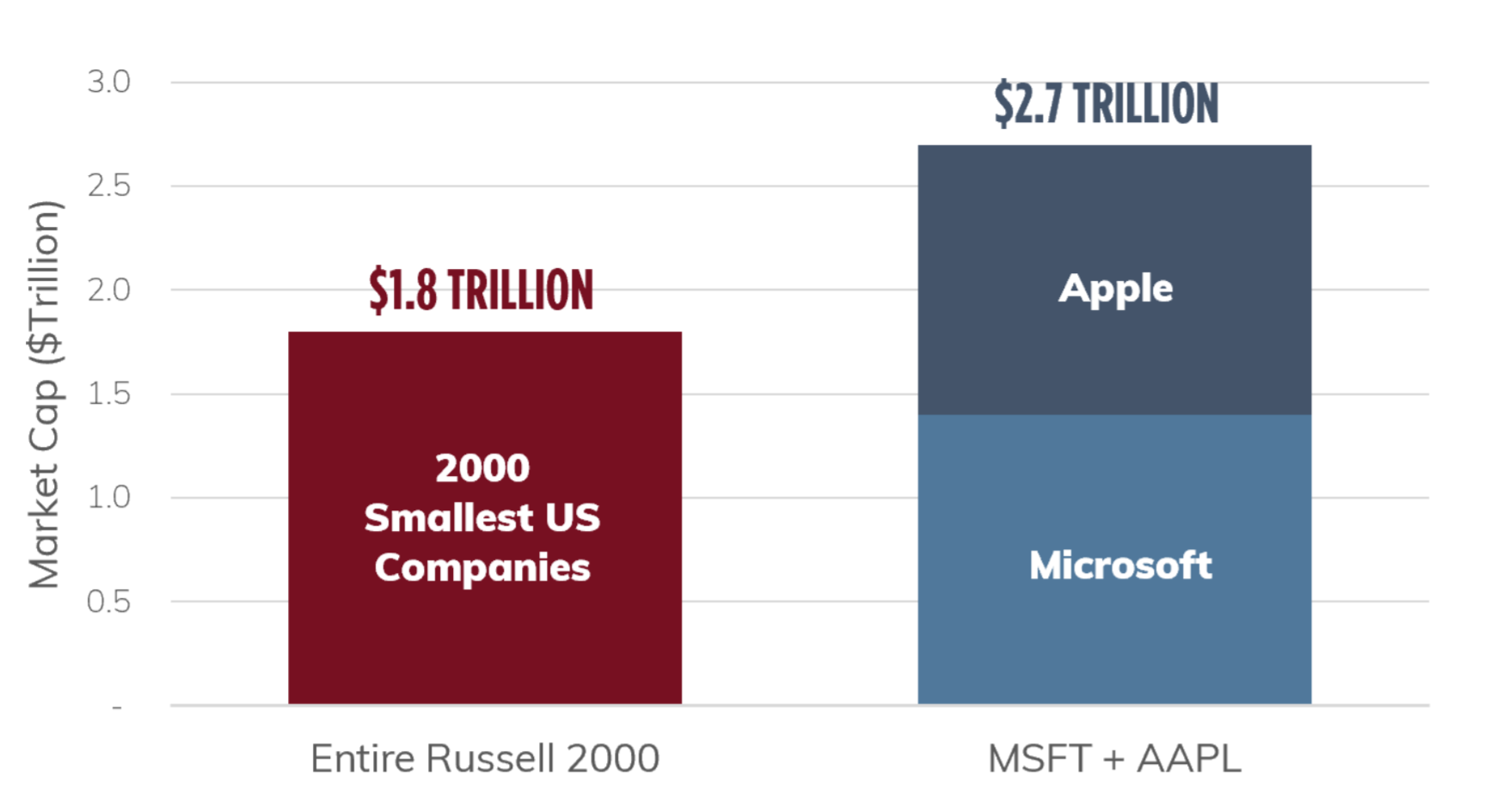

A company’s total market capitalization, or ‘market cap,’ is the total value of its stock. Microsoft has a market cap of $1.4 trillion, while restaurant company Shake Shack has a market cap of roughly $2.0 billion. Companies with large market capitalizations, often called ‘large-caps’, account for over 70% of the total U.S. stock market value. Stocks with smaller market capitalization, or ‘small-caps’ occupy far less territory. However, many of the large-caps were once small-caps, and it is this potential for growth that makes small-caps attractive.

Over longer periods of time, small-cap stocks as a group have demonstrated greater growth than their large-cap counterparts. Intuitively this makes sense in that smaller companies have more room to grow and can be nimbler in response to growth opportunities. However, smaller companies also tend to have fewer business units and revenue sources, which can make them more vulnerable to the business cycle, emerging competition, and other disruptive forces. Because of these differences, small-cap stocks are treated as a distinct asset class with size alone being the determining factor. But this big-picture, asset class view of small-cap stocks can lead to biases that drive investment decisions based on faulty assumptions.

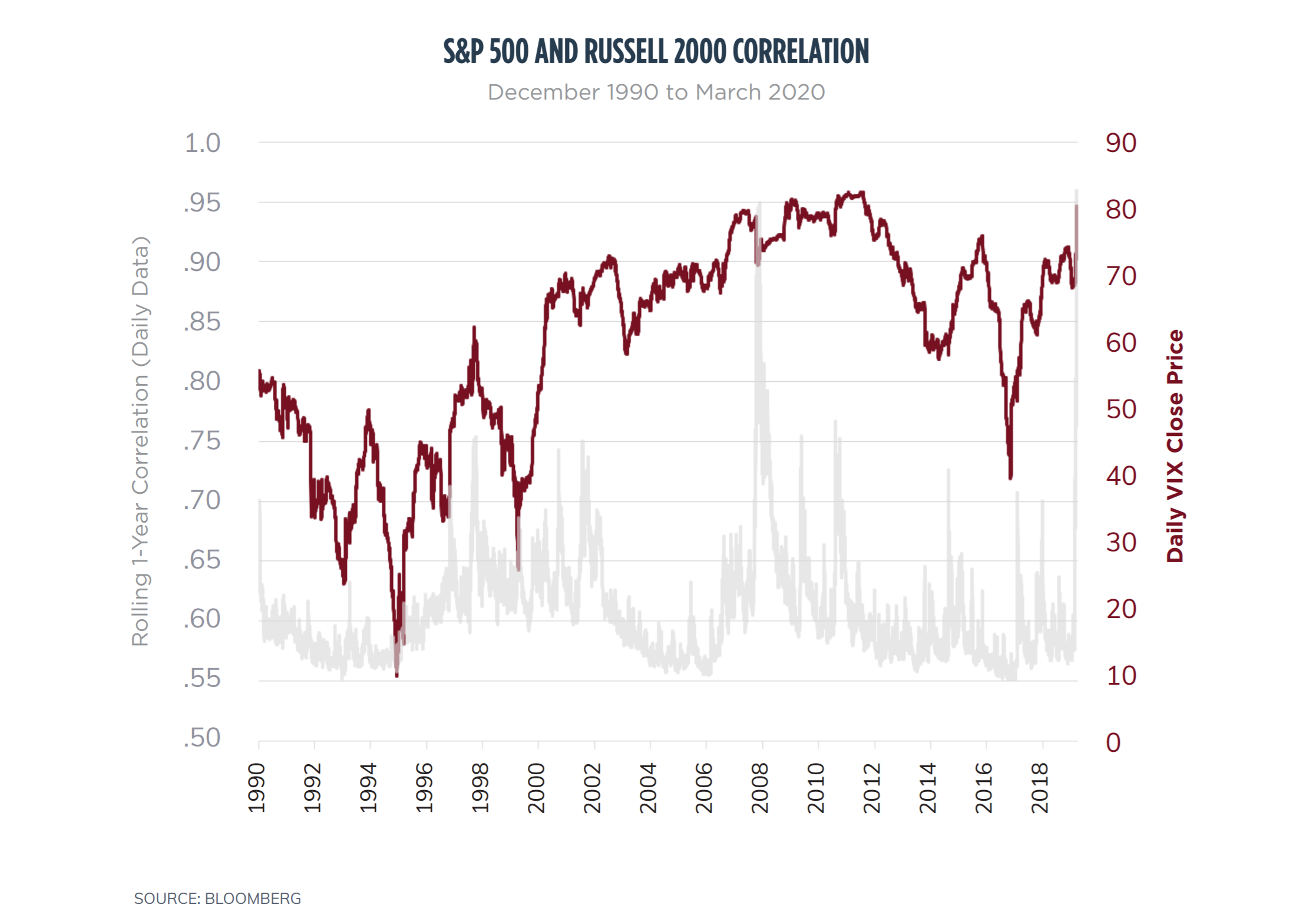

Conventional wisdom would make the case that adding small-cap stocks to a large-cap portfolio offers diversification benefits. The presumption is that small and large companies will respond differently to economic and market forces, and as a result, offer some measure of counterbalance. This presumption of diversification deserves some scrutiny. It’s true that the two groups behave differently over very long periods of time; but over shorter periods of time, particularly during sudden market downturns, the diversification benefits all but disappear as small-caps and large-caps tend to fall in lock step.

The graph below shows the one-year rolling correlation of daily returns for the S&P 500 and Russell 2000 indices. The correlation measures the extent to which the two indices move together. A correlation of 1.0 would suggest the two indices move identically. A higher correlation between two assets indicates they behave in a similar manner, and that combining them would offer little diversification benefit. Not only has the correlation between the large-cap and small-cap indices been rising over time, but in times of market stress (2001–2002, 2007–2009, and most recently 2020) the correlation between the two indices rose, reducing the diversification benefit when it was needed the most.

We believe that investors should focus on the growth opportunities smaller stocks provide and not look to these stocks for diversification. Our view is that a company that demonstrates a distinct competitive advantage and prudent fiscal stewardship is best positioned to generate profitable growth. Simply put, the factors leading to the success of an individual company, large or small, are the same. Therefore, we believe the best way to uncover growth potential in small-cap stocks is to approach the space one stock at a time, focused on the key characteristics that define quality, compounding companies — mirroring our approach to the large-cap stock universe.

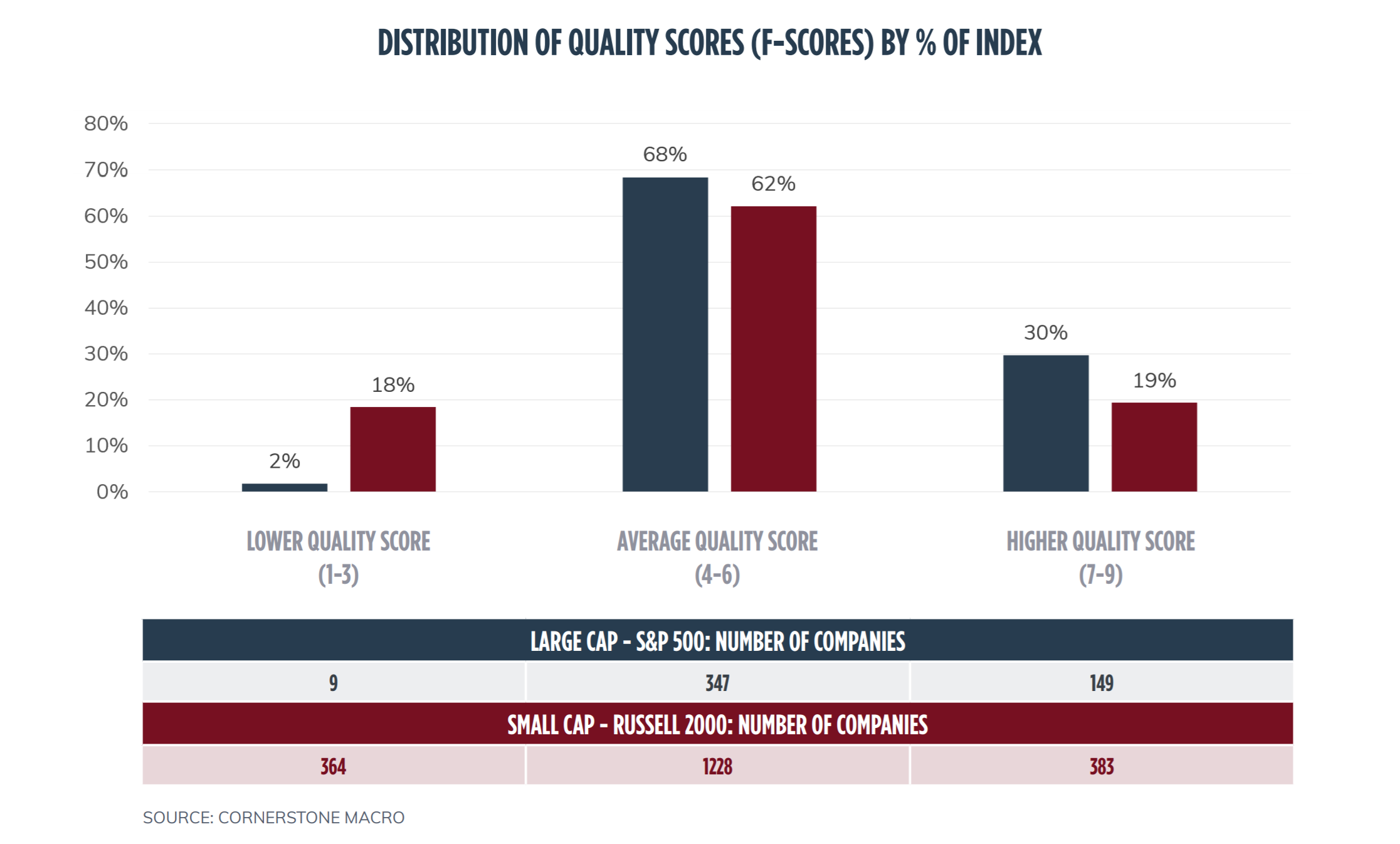

There are small economic castles with strong fundamental characteristics; but as with anything smaller, they can be harder to find. The small-cap universe is made up of thousands of companies, many of which are in the nascent stages of their development. Accordingly, a lower percentage of the total universe possess seasoned management teams, stable access to capital, and consistent growth. To distinguish among companies in this universe, we use a quantitative measure of quality and financial strength, the “Piotroski F-Score.” While this may sound like a metric concocted at NASA, it is a simple cumulative score based on nine criteria in the areas of profitability, liquidity, and operating efficiency. Either the company meets the criteria, and gets 1 point, or it doesn’t. A score of 9 means the company met all criteria, signaling very strong financial and operating performance. The graph and table below summarize the F-Score distribution when applied to large-cap companies in the S&P 500 index and small-cap companies in the Russell 2000 index. The results show there are an almost equal number of low-quality scores as high-quality scores in the small-cap universe, while the large-cap universe tends to be higher quality on average.

Sifting through the large number of companies in the small-cap universe to qualitatively assess the opportunities can present a formidable challenge. Many advisors do not have the resources to generate the volumes of research necessary to evaluate each company. Some choose to gain portfolio exposure to small-cap stocks by buying a mutual fund or ETF that invests in the total Russell 2000 small cap index. However, such a passive approach means committing capital to many lower-quality stocks. Our view is that the small-cap universe is well-suited to offer value through active stock selection. In addition to a wide dispersion of quality in the realm of small stocks, fewer Wall Street and institutional analysts follow them. With fewer eyes on each stock, there is greater opportunity to uncover growth companies that may be overlooked, misunderstood, or underappreciated by the market.

To give our clients exposure to the highest-quality small-cap stocks, we thoroughly vet and partner with top-tier specialty investment managers who have focused expertise and successful track records of selecting quality small-cap companies.

The decision to increase or decrease the small-cap exposure in a portfolio should be based on the improvement of fundamental characteristics. In other words, we need to determine whether adding small-cap stocks will improve the profitability and value of the total portfolio. In general, we believe the investment industry is predisposed to a top-down, dogmatic view of small-caps that lumps the entire opportunity set into one homogeneous asset class, which in our view, totally misses the point.

The industry view emphasizes size and style factors above quality fundamentals. Because a large percentage of small-cap stocks have cyclical earnings and lower returns on invested capital, many investors will shed small-cap portfolio exposure when market stress is rising. We, on the other hand, take a bottom-up view, tending to add small-cap exposure as many in the industry reduce it.

During periods of market turmoil, there is a tendency for higher-quality small-cap companies to get caught in the downdraft of capital flowing away from the asset class. We look to be opportunistic at these times, and when appropriate, seed our small-cap investment partners with additional capital to seek out quality companies with depressed valuations.

Large or small, domestic or international, H.M. Payson is focused on high quality stocks characterized by consistent earnings growth and strong balance sheets, as well as high margins and above-average returns on invested capital. Companies with these characteristics typically have seasoned management teams and strong competitive positions that give them an advantage in difficult market environments. These are the economic castles we look to add to client portfolios, no matter the size.

This newsletter is intended for educational purposes only. For financial planning advice specific to your needs or for further information, please consult your portfolio manager.