As you’ve read in our previous notes, we continue to advise clients to stick to their long-term investment plans. Our asset allocation philosophy is to have three to five years of your liquidity needs in cash and bonds, with the rest invested in stocks for growth. Adhering to this philosophy alleviates the need to sell stocks in bear markets.

This note will explain, through a simple mathematical model, why we feel our long-term approach is justified. The model also helps explain why the market has rebounded so strongly following prior crises where uncertainty was high.

The value of a company is the sum of the cash flows it can produce over time. To determine a company’s “fair” or “intrinsic” value over time, most analysts use what is called the Discounted Cash Flow model (or some version of it).

Many assumptions about the future go into this model, including cash flows, growth, interest rates, and investor risk tolerances. It is sensitive to changes in these inputs and can give a wide range of results, but it is useful during market extremes to check what market expectations are relative to current prices.

There is ample uncertainty surrounding the duration of the COVID-19 crisis and the extent of the damage to the economy and public company earnings. Not knowing near-term cash flows creates uncertainty surrounding a company’s fair value, which amplifies near-term price volatility. But if you look at the model closely, very little of the total value of a company comes from near-term cash flows. In fact, more than 95% of a company’s value comes from cash flows two years out and beyond.

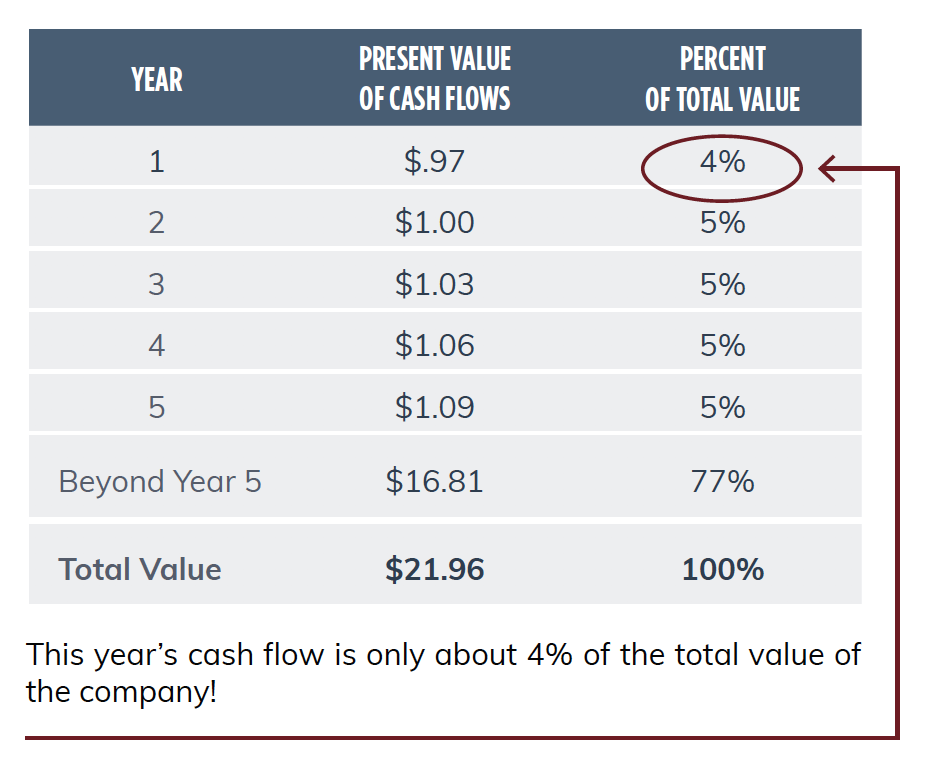

To illustrate this point, here we have a company that is expected to earn $1 over the next year. We assume the following: its earnings will grow by the long-term S&P 500 average of 6%, inflation will be 3%, and the terminal discount rate will be 7%. The “fair” or “intrinsic” value of this company using the Discounted Cash Flow Model, is as follows:

The total value of the company in this example is almost $22. Of this total value, this year’s cash flow makes up only about $1. If this year’s cash flow falls by 100% and goes to $0, the company is still worth $21. Even if the company experienced a complete loss of cash flow for this year, its fair value only falls about 4%!

This model is used by many analysts to determine the intrinsic value of the S&P 500 by simply adding the values of all the cash flows of its constituent companies. The S&P 500 was expected to have earnings of $165 this year prior to the crisis, with these earnings making up about 5% of its total value. Wiping out this year’s earnings would erase 5% of the value of the index, yet as of this writing, the index has fallen over 30%.

The Discounted Cash Flow model has many flaws, which is why analysts at HM Payson don’t rely strictly on it to determine fair values of the companies we follow. But it does illustrate the point that investors tend to over-react and extrapolate the effect of uncertainty in times of crisis. It may also explain why markets have recovered and soared to new highs following prior times of uncertainty and crisis.

We are in no way underestimating the historic nature of this crisis, as we are seeing unprecedented effects on small businesses and public companies with this temporary shutdown of our economy. The size of the impact on this year’s earnings remains unknown. We did expect the market to pull back from its highs; but a long-term value framework shows us that the current market pullback is overdone.

We will continue to advise clients to hold onto the high-quality companies they own, knowing that a recovery will eventually happen. We also understand that most of the value in these companies comes from the business they will do next year and beyond. While we are expecting and prepared for the market to continue to decline in the near term, we also expect its recovery to be rapid, which discourages us from attempting to time when we sell and when we buy.

This newsletter is intended for educational purposes only. For financial planning advice specific to your needs or for further information, please consult your portfolio manager.